If you prefer to bypass The Big Story and jump straight to the Local Market Report, click here.

The Big Story

Quick Take:

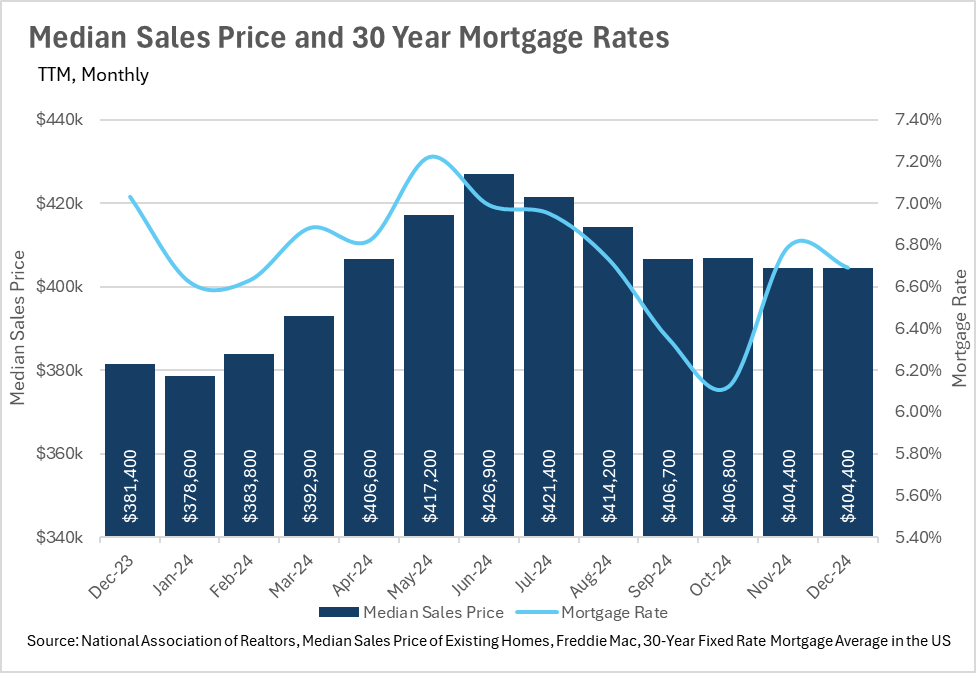

- Mortgage rates have ticked back up to roughly the same levels, as they were at prior to the Fed issuing its first rate cut in September.

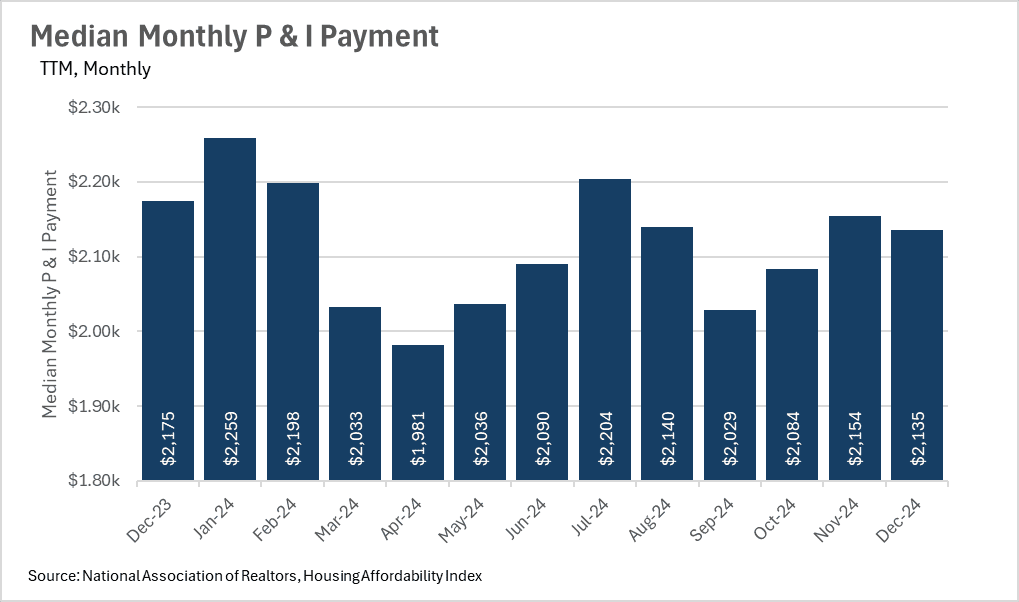

- Although housing affordability remains a concern, things have gotten slightly better year-over-year, with median monthly P&I payment decreasing by 1.84%.

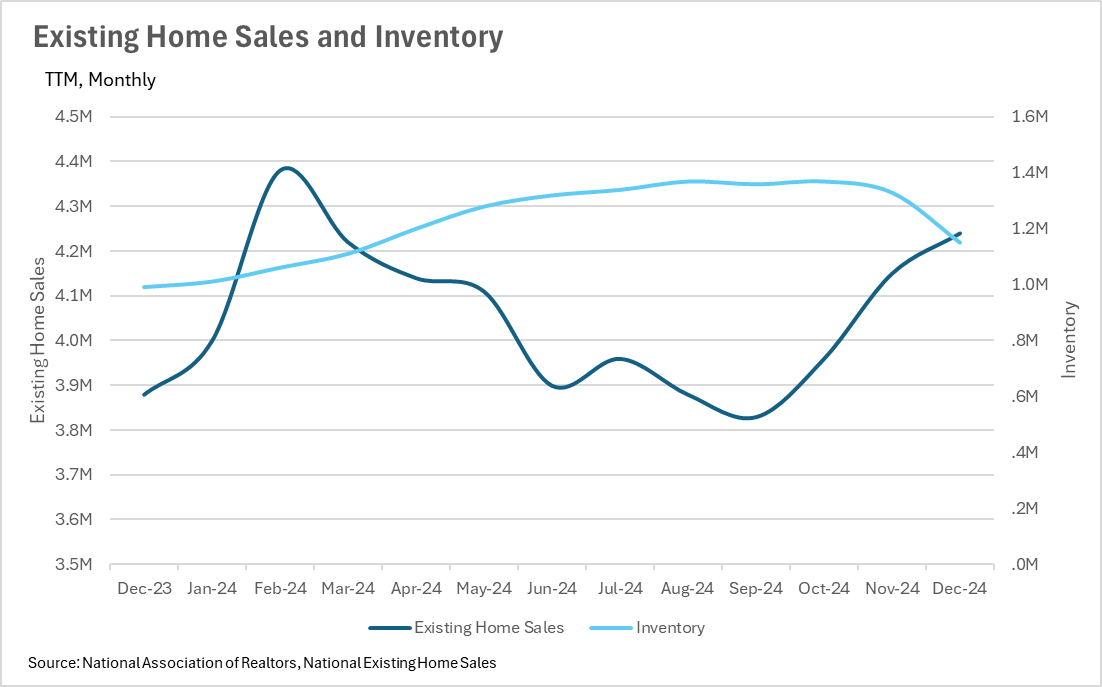

- Year-over-year growth in inventory is outpacing existing home sales by roughly 7%, meaning we could see affordability begin to increase over the coming months.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Mortgage rates have returned to pre-rate cut levels

One very interesting phenomenon that we’ve seen play out over the past few months is that interest rates have largely returned to the levels that we saw prior to the Fed’s first rate cut in September. Unfortunately this is not what the market at large was expecting to see, since mortgage rates typically move in tandem with the Federal Funds rate. However, this suggests that the lending market expects the rate cuts that we have seen recently to be short lived, meaning that the lending market is expecting the Fed to begin increasing rates again within the coming years. This could be due to a variety of reasons, but inflation is the most likely culprit for rate hikes, as it has remained rather stubborn since it first became an issue in 2022.

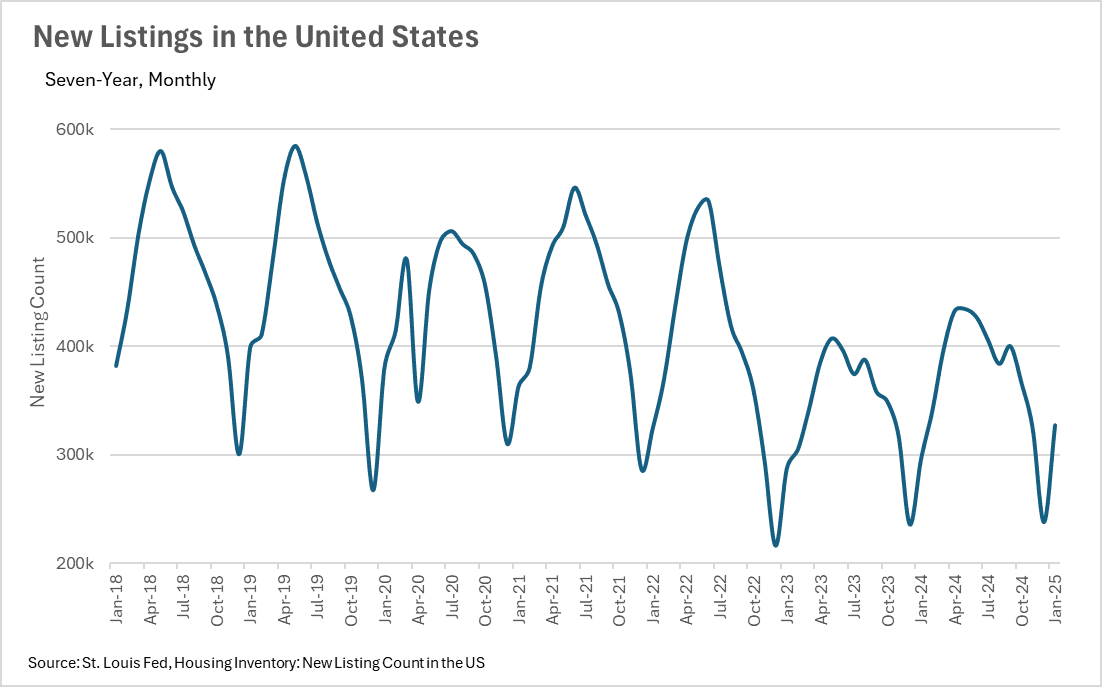

Inventory is finally starting to build throughout the US

As we all know, inventory levels have been an issue Post-COVID, across the entire country, with many areas not having nearly enough inventory to support buying demand. This, in turn, helped to push up the values of homes nationwide.

It’s important to note though, that we’re beginning to see inventory growth outstrip existing home sale growth, as in December, inventory grew by 16.16% on a year-over-year basis, whereas existing home sales grew by 9.28% year-over-year.

Median sale prices continue to rise, despite interest rate headwinds

Many buyers still have the mortgage rates that they saw in 2021 and 2022 at the top of their mind, making it difficult for them to justify locking in a mortgage in the 6%-7% ranges that we’ve been seeing over the past couple of years. Despite many buyers sitting on the sidelines, and waiting for lower rates, we’re still seeing the median sale price of homes increase.

In both the months of November and December, the median sale price of a home in the United States was $404,400. This represents an increase in value of 6.03%, when compared to the December 2023 median sale price of $381,400. This is slightly concerning, given that the growth in median sales price continues to outstrip the growth in inflation, with December’s year-over-year CPI figures coming in at 2.9%.

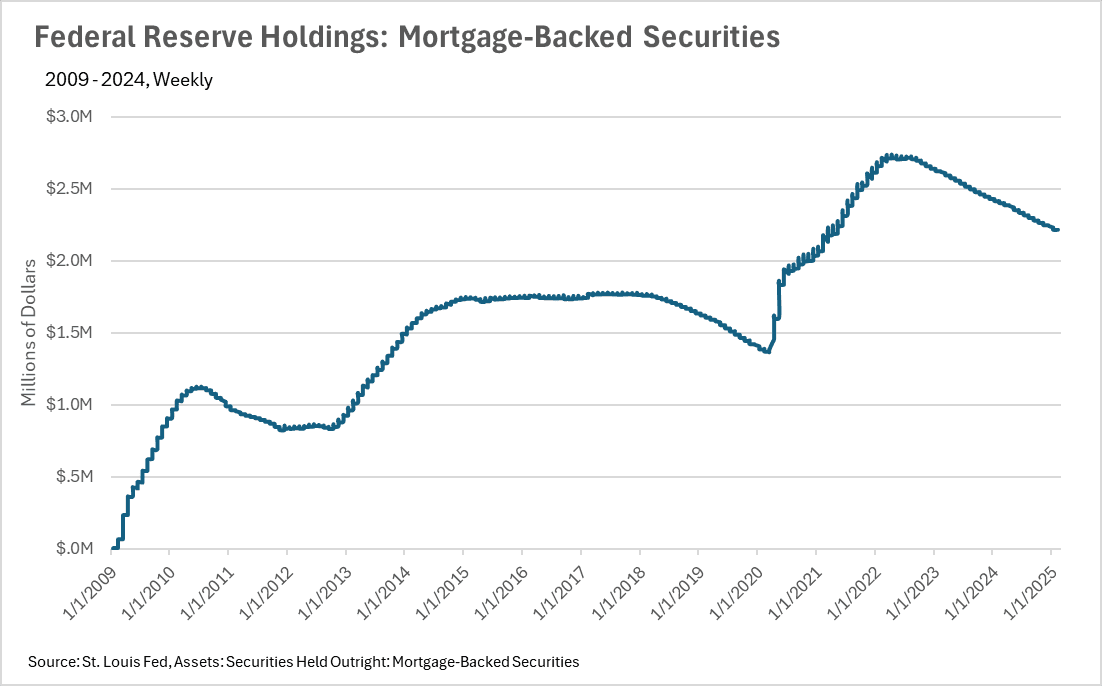

The Fed continues to unwind its mortgage backed securities

As many of us know, in addition to the Federal Funds Rate, the Fed also has control over its own balance sheet. Throughout the COVID crisis, the Fed ramped up its purchase of mortgage backed securities at a rate we haven’t seen since the Great Financial Crisis. However, the Fed has since been unwinding its holdings of MBS’s at a steady rate, since late 2022, which it continues to this day.

How does all of this affect my local market

Although it’s great to know what’s happening at a national level, real estate is an incredibly localized industry. There are areas throughout the country that are doing considerably better or worse than the nation at large. To ensure you’re informed on the happenings at both a national level and a local level, we’ve included our local lowdown below. In our local lowdown, you’ll find the in-depth coverage you need to stay in tune with your area. As always, we’ll be monitoring the housing market and the economy from both a macro and micro level, and report back to ensure you’ve got the data you need to make the best decisions possible!

Big Story Data

The Local Lowdown

Quick Take:

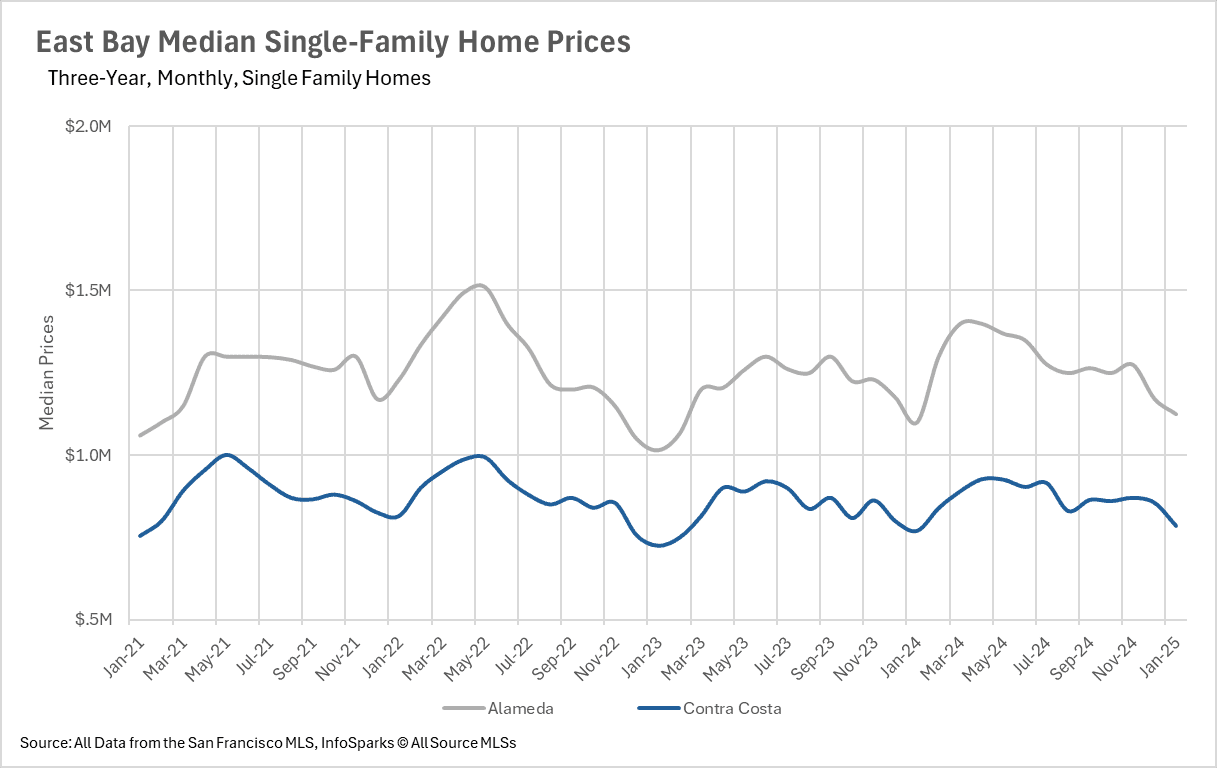

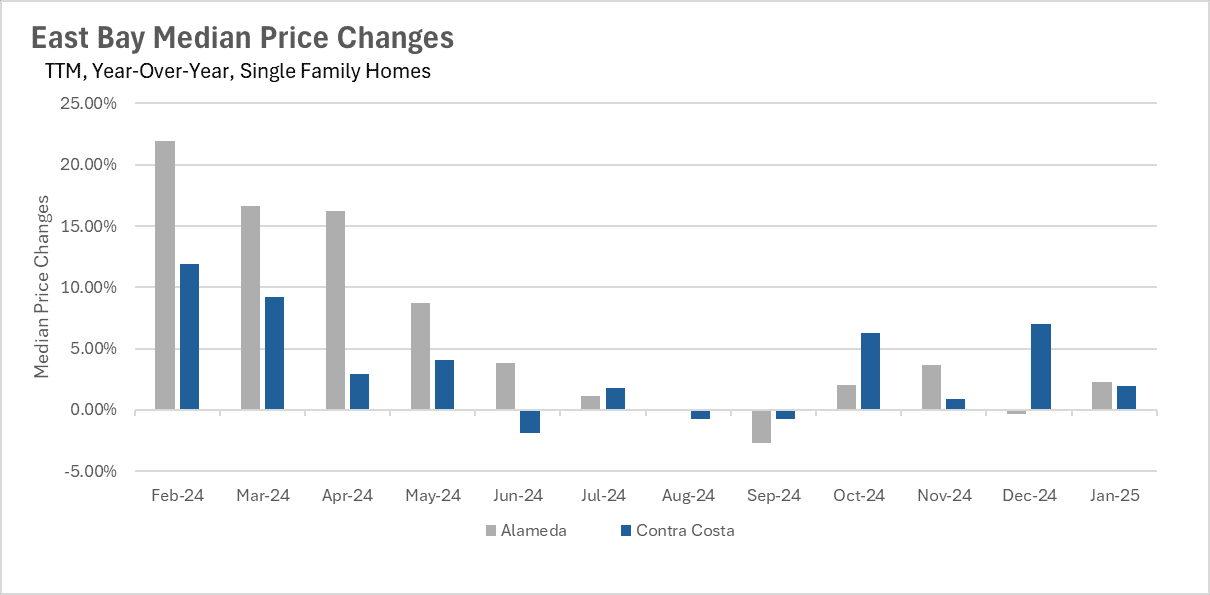

- Pricing is remaining very strong in the East Bay, with single-family home median sale prices in January creeping up by 2.27% and 1.95% in ALameda and Contra Costa counties, respectively.

- Despite relative strength in terms of median sale pricing, inventory levels continue to rise in both the single-family home market as well as the condo market.

- We’re currently seeing a divergence in the number of days that homes are sitting on the market in Alameda and Contra Costa counties that might surprise you!

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Median sale prices remain strong throughout the East Bay

Given the explosive growth in median sales prices that we saw during the beginning of 2024, one might expect that the market would give up some of these gains throughout the holiday months. However, the East Bay remains incredibly strong, with Alameda and Contra Costa Counties experiencing 2.27% and 1.95% year-over-year increases in single-family home median sales prices in January.

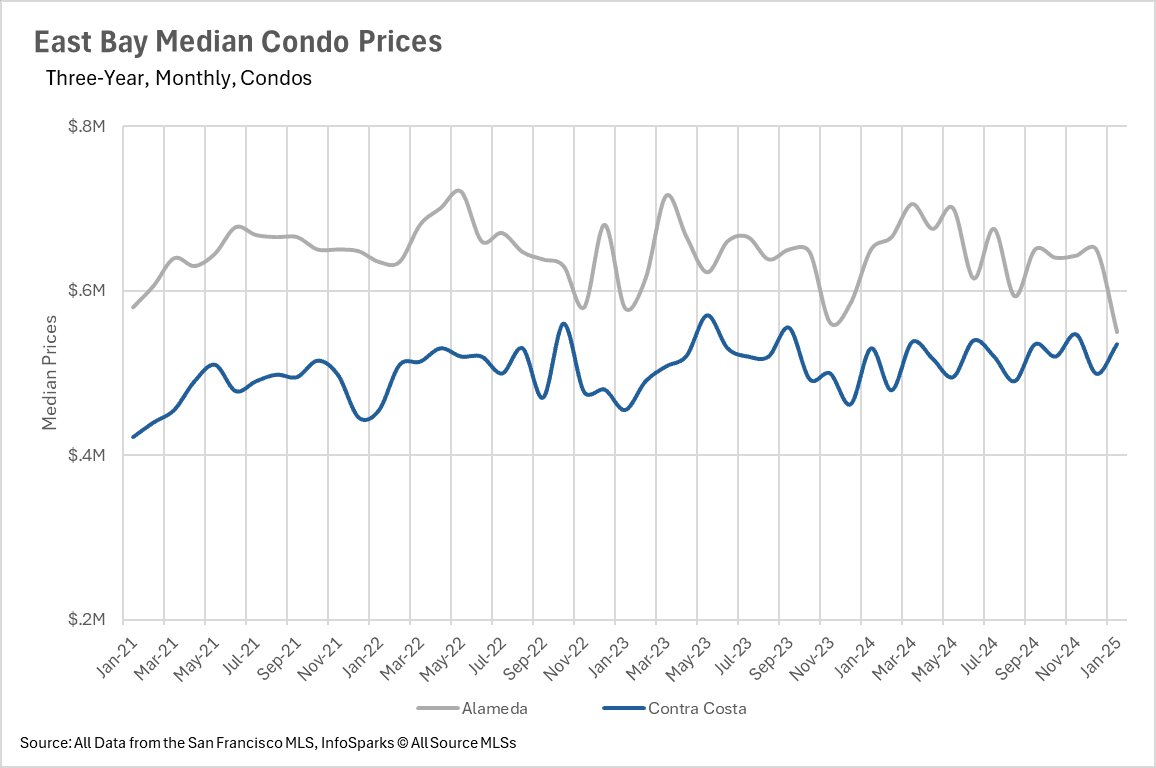

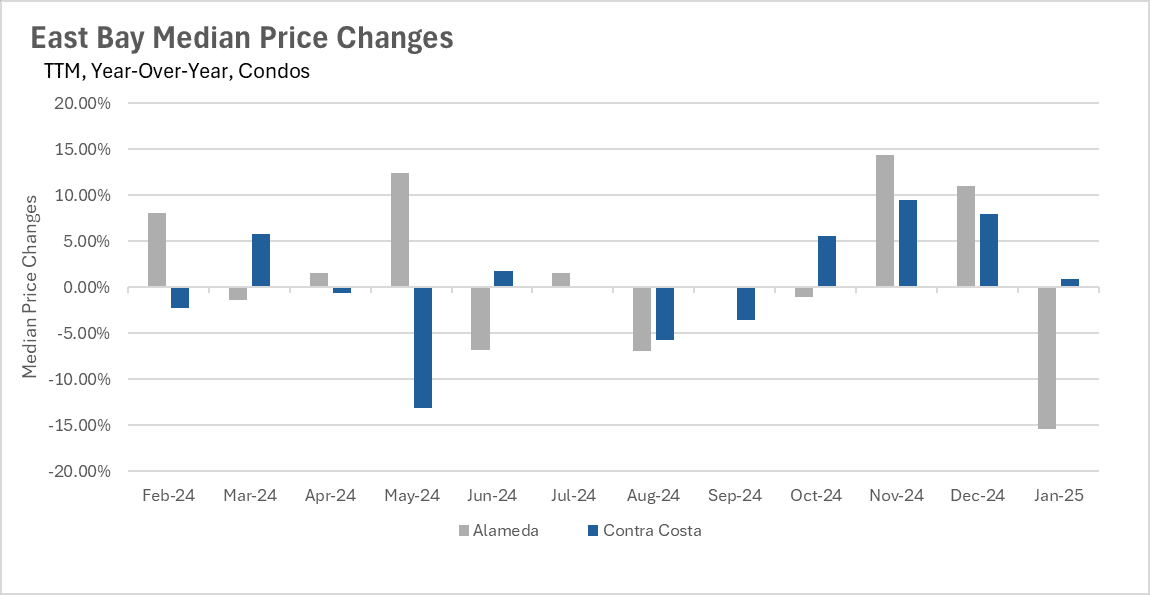

Likewise, condo pricing in Contra Costa County remained relatively strong with a 0.95% year-over-year increase. However, condos in Alameda County saw a 15.38% year-over-year decrease. It’s interesting to note that as interest rates began to rise after the Fall rate cuts, the East Bay at large remained relatively strong in terms of median sale price.

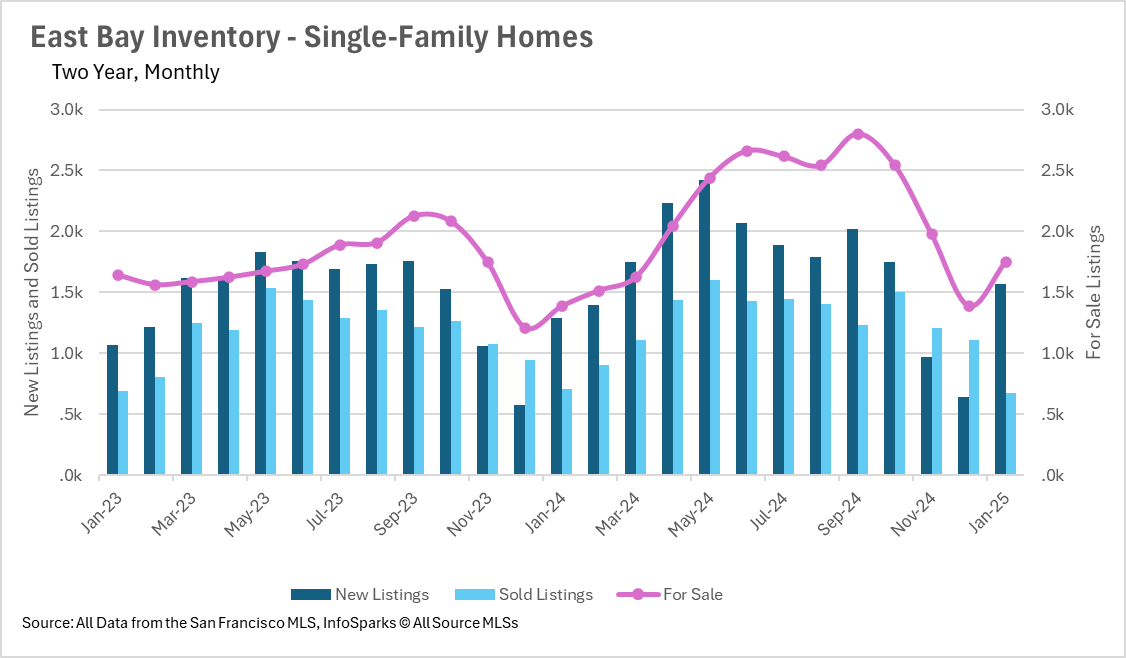

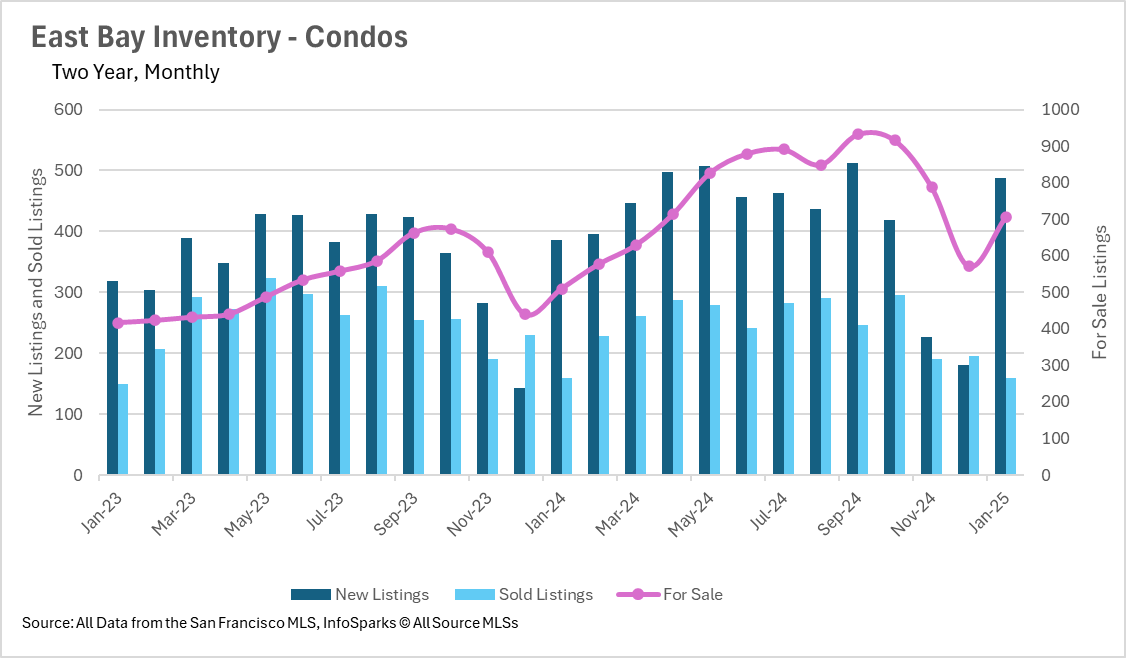

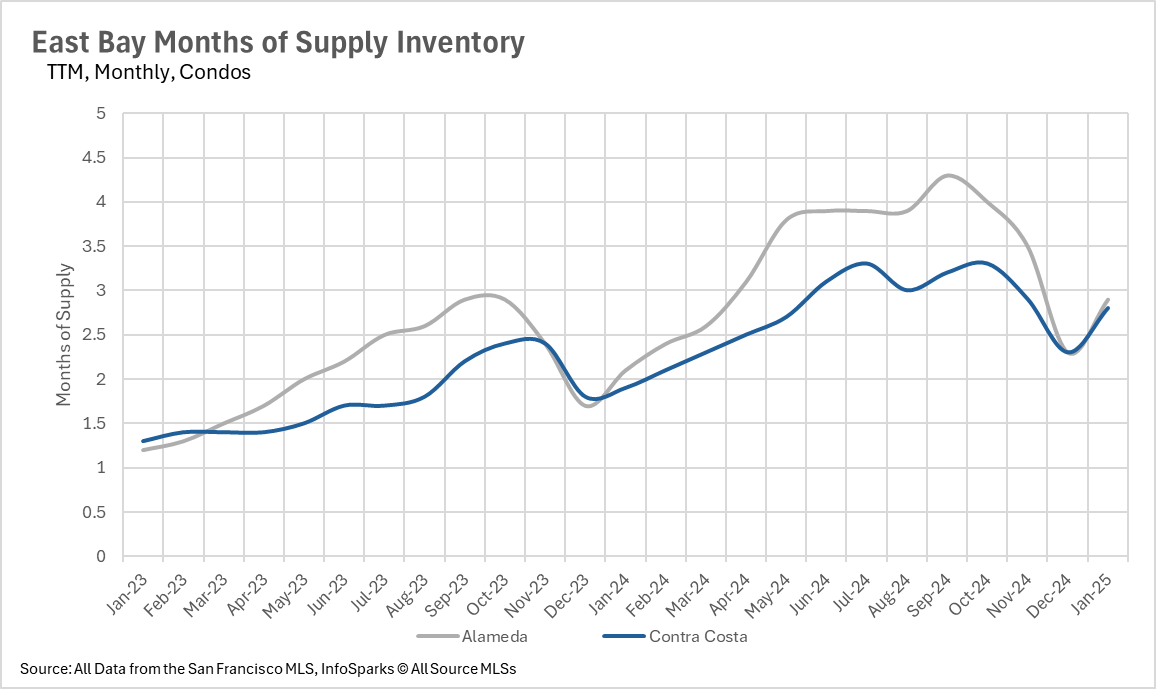

Inventories are one of the most important leading indicators of price trends, and we’re seeing quite the increase in inventories in the East Bay in terms of both single family homes and condos.

In January, there was a 21.59% increase in the number of new SFH listings, and a 26.39% in active SFHs. While it’s worth noting that the SFH market had very low inventories around this time last year, the condo market did not, so it’s interesting to see that that there was a 26.42% increase in the number of new condo listings, and a 38.24% increase in the number of active condo listings.

We’ll have to follow the trend, but this could mean that there will be some great buying opportunities for condos in the near future.

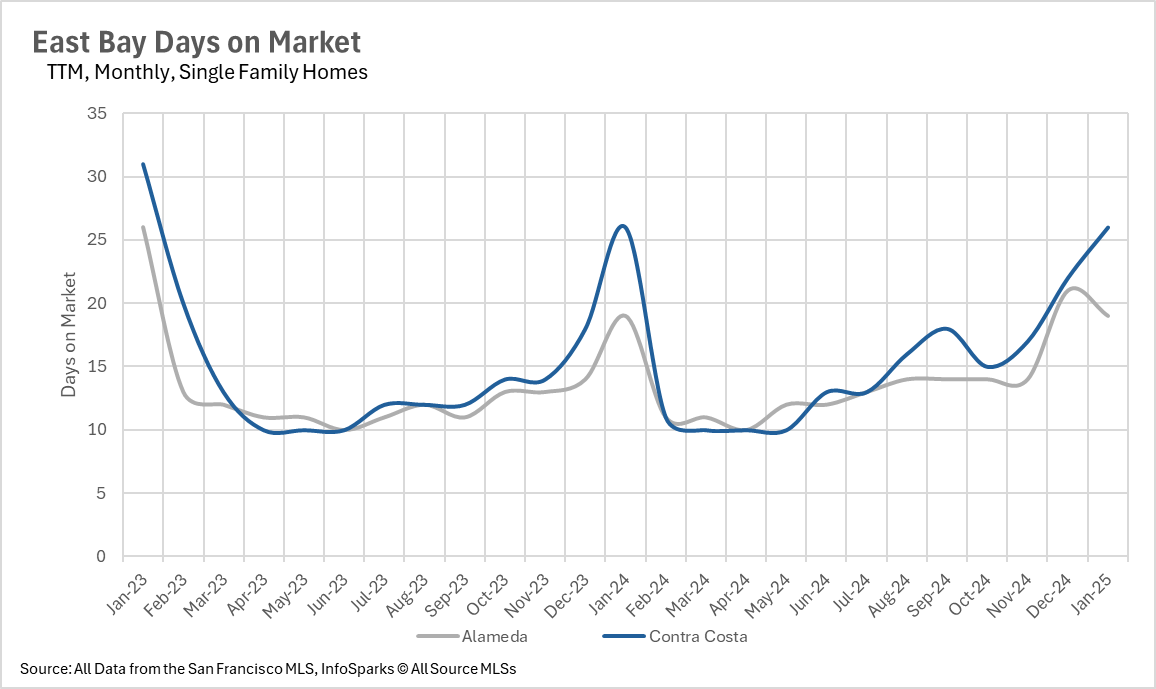

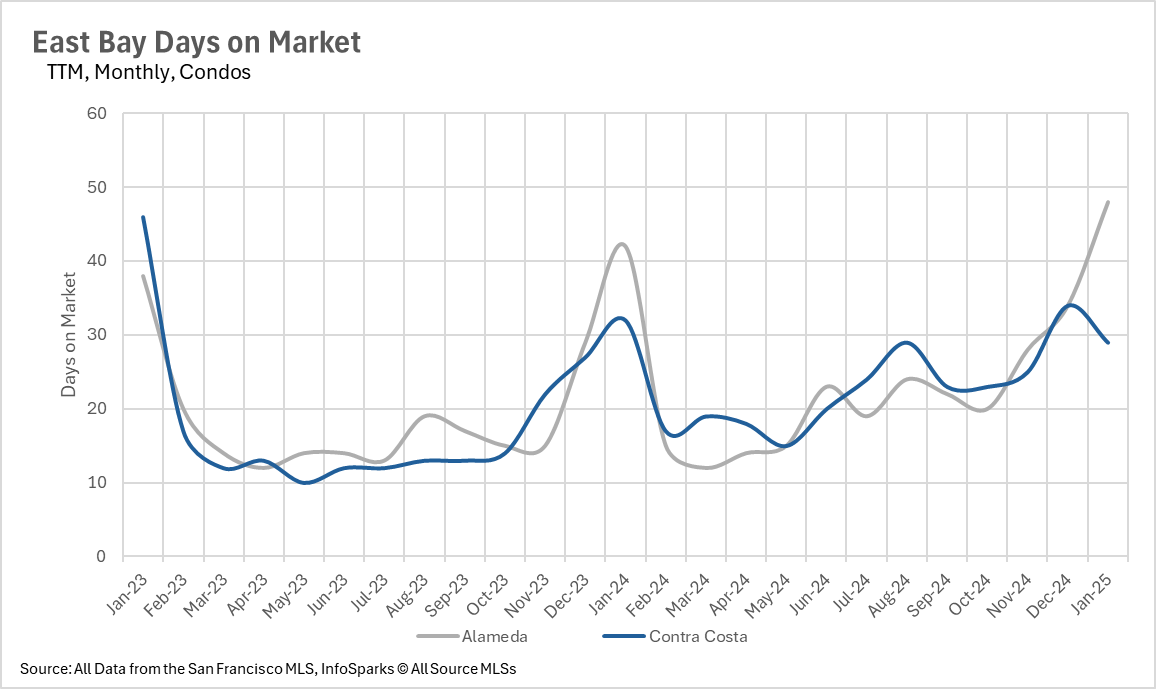

An interesting divergence in the number of days on market

Although there is typically a slight divergence in the number of days on market between Alameda and Contra Costa Counties this time a year, the difference is seemingly more pronounced this year. Single family homes are sitting on the market for roughly 26% more days in Contra Costa County than Alameda County. On the flip side, condos in Alameda County are sitting on the market for 65% longer than condos in Contra Costa County!

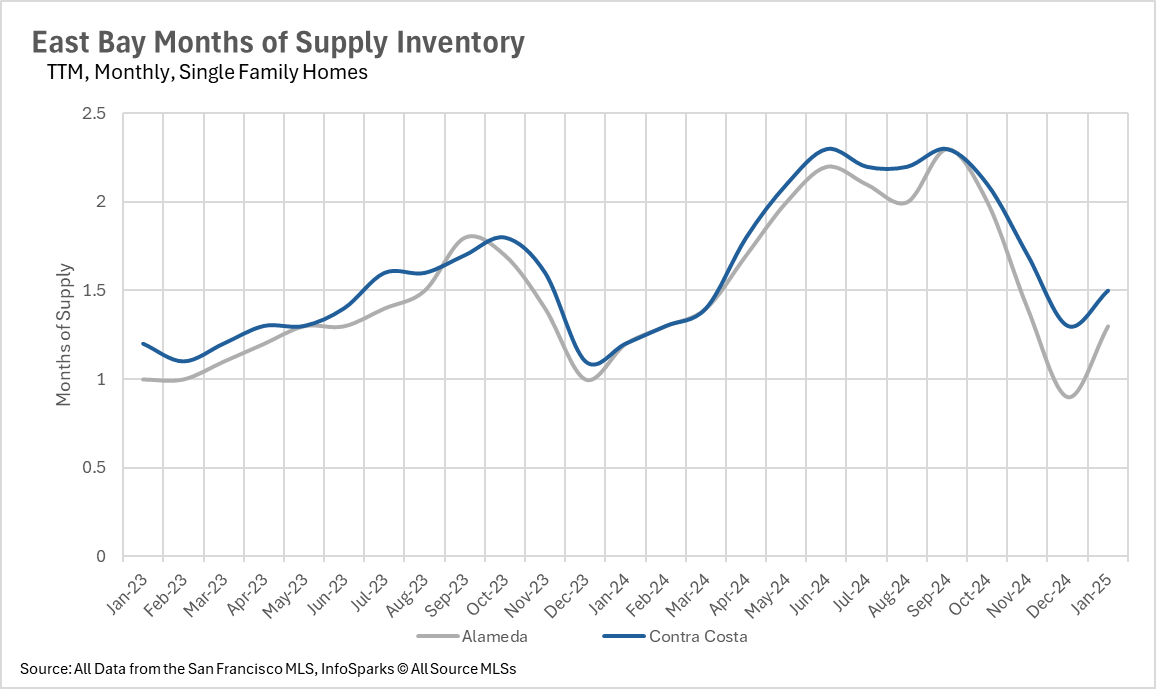

The East Bay continues to be a sellers’ market

When determining whether a market is a buyers’ market or a sellers’ market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a sellers’ market, whereas markets with more than three months of MSI are considered buyers’ markets.

Although the condo market teeters on the edge of being balanced, with 2.9 months of supply in Alameda County and 2.8 months worth of supply in Contra Costa County, there’s a much different story when it comes to single family homes. The SFH market remains a very strong sellers’ market in both Alameda and Contra Costa Counties, with there being 1.3 and 1.5 months worth of supply on the market, respectively.