If you prefer to bypass The Big Story and jump straight to the Local Market Report, click here.

The Big Story

Sellers are coming back to the market

Quick Take:

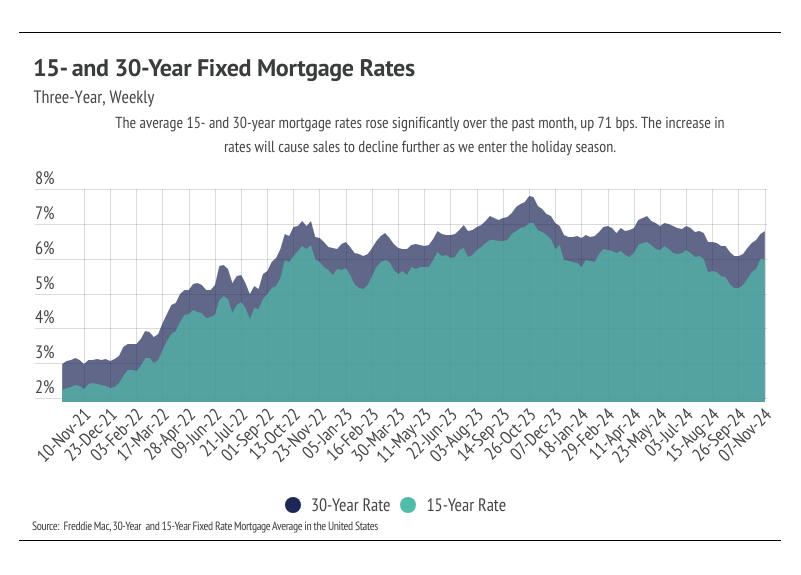

- After the election of Donald J. Trump, bond prices increased in anticipation of his inflationary policy positions. Interest rates are the most significant factor financially in purchasing a home for most buyers, and as we’ve seen over the past two years, higher rates translate to lower sales.

- From October 1 – November 7, the average 30-year mortgage rate rose 71bps, landing at 6.79%. The Fed cut rates by 50 bps in September and another 25 bps during the Fed’s November 6-7 meeting.

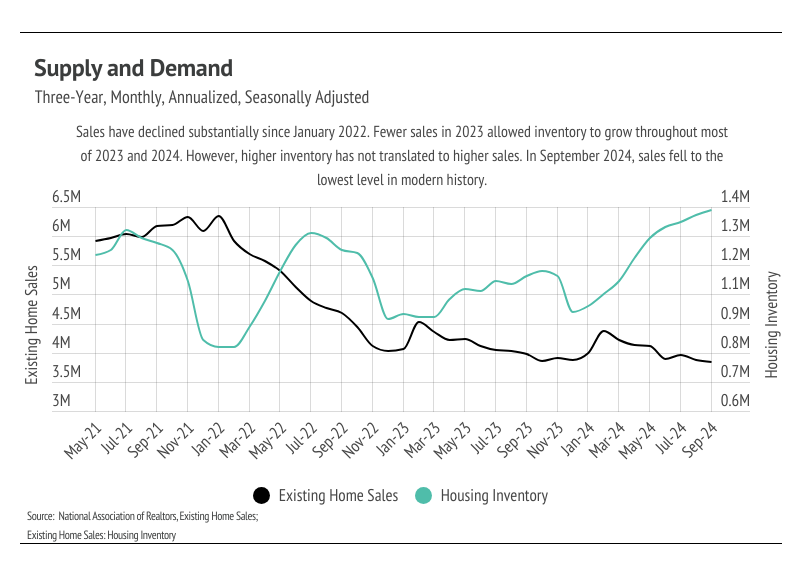

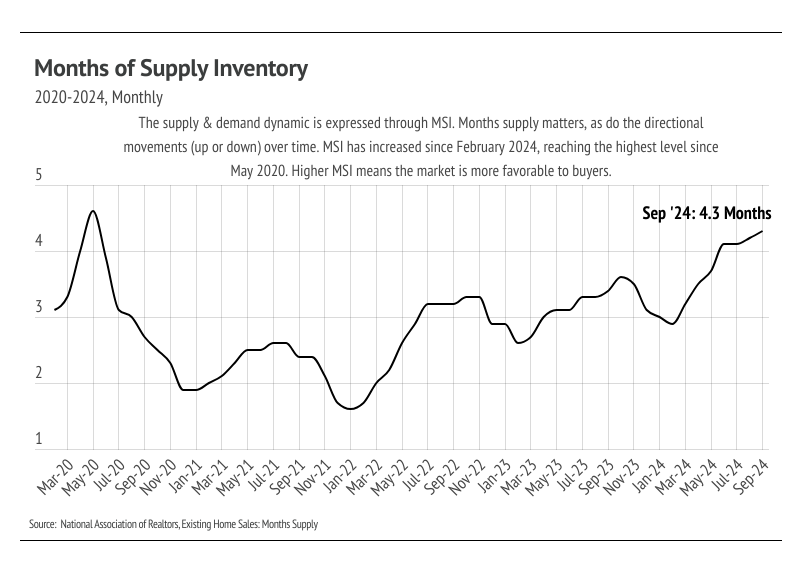

- Sales declined 1.0% month over month, falling to the lowest level in modern history, while inventory rose to its highest level since 2020. The spike in mortgage rates should further slow the market in the winter months.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

Bond and mortgage rates are risings as the Fed is cutting rates

Let’s talk about rates. The benchmark 10-year Treasury rate rose by as much as 18 basis points the day after the election, pushing the overall rate on the bond to 4.47%. The price of bonds and their yield move inversely, with prices falling as rates rise. For example, if you have a $100 bond paying 10% and then rates rise to 20%, the original $100 at 10% becomes less valuable because now investors could get a $100 bond that pays 20%. A rising yield on Treasury bonds raises the cost of the U.S. federal government when it borrows new money or rolls over existing debts. In short, the cost of borrowing increases and, therefore, more money is needed to pay interest rather than paying for tangible government programs. The 30-year mortgage rate trends with the 10-year Treasury rate, usually about 2% higher. As of November 7, 2024, the average 30-year mortgage rate was 6.79%, a significant increase from 6.08% at the end of September. In just over a month’s time, the monthly payment on a $500,000 loan increased 7.7%.

But the question you may be asking is, why did rates go up even in the wake of the Fed cutting the federal funds rate? Real interest rate returns account for inflation, so the $100 bond at the nominal rate of 10% can be rewritten as 10% minus inflation (currently 2.4%) to get the real return of the investment. If inflation is expected to rise, the nominal rate can increase, so real return is unaffected or, at least, less affected,, in which case real return would decrease. Trump’s economic plans are inflationary and, therefore, increase rates. The U.S. economy is operating at close to capacity, and unemployment is low. Tax cuts will increase demand, but higher tariffs will push up prices. The U.S. is a net importer, so blanket tariffs will drive up the prices of an incredible number of day-to-day goods. Higher inflation will result, meaning the Federal Reserve will be more cautious about cutting interest rates.

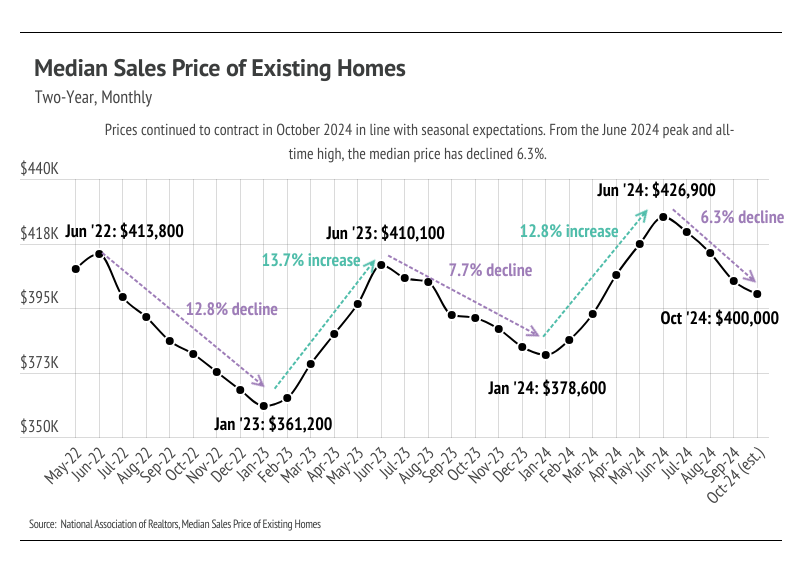

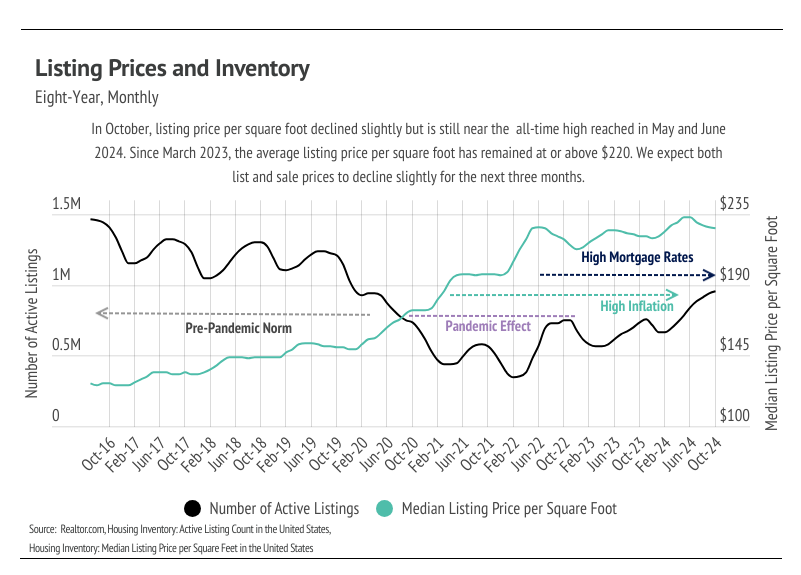

Currently, mortgage rates rise higher when the housing market already tends to slow. Typically, the holiday season experiences fewer sales then picks up again in January. A month ago, rates were dropping, and we were extremely bullish on the spring market. However, if rates rise above 7% or higher, the market will be slower than usual. Since the market has already been slower than usual, a further slowdown coupled with higher inflation would likely slow price growth next year.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

Quick Take:

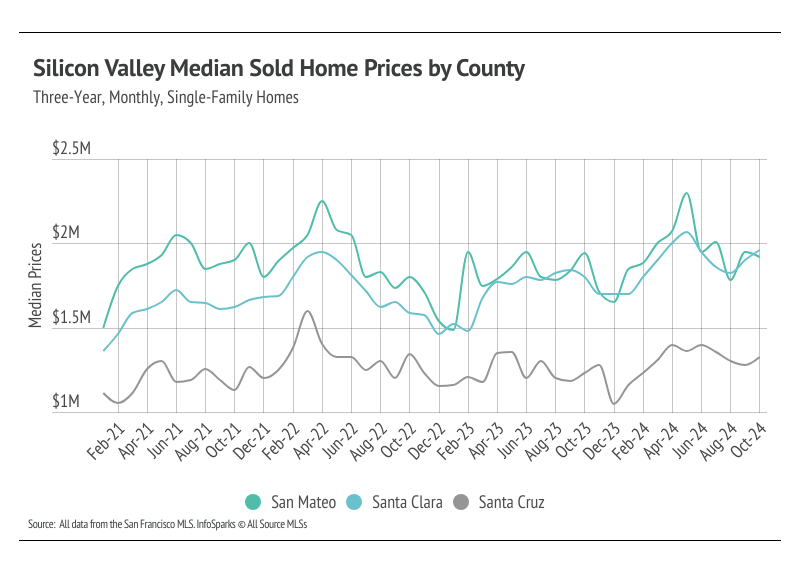

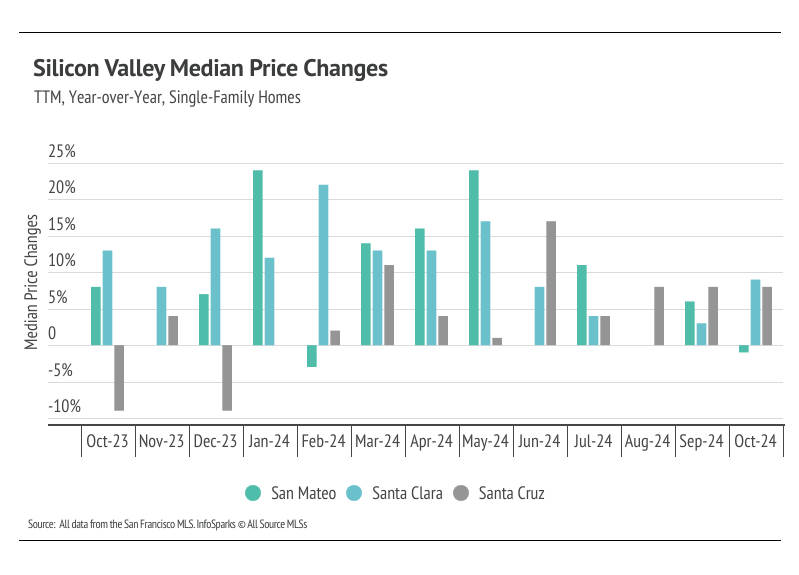

- Median home prices are slightly below peak levels across Silicon Valley. We expected price contraction after peaking in the second quarter, which is the seasonal norm. Prices will likely decline for the rest of the year.

- Total inventory rose 15.0% month over month, as new listings fell and sales of single-family homes increased. However, we expect inventory to decline and the overall market to slow over the next three months.

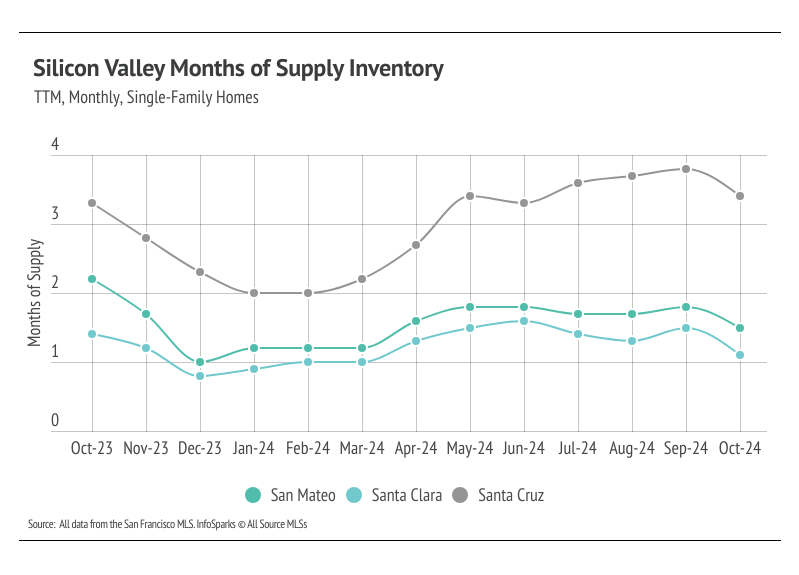

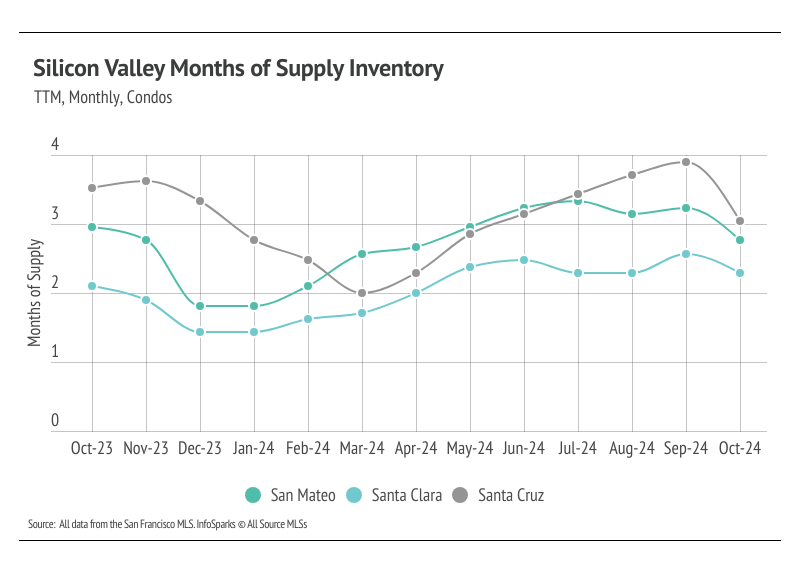

- Months of Supply Inventory indicated a sellers’ market for single-family homes in San Mateo and Santa Clara and a balanced market in Santa Cruz.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

The median single-family home prices are up year to date and year over year

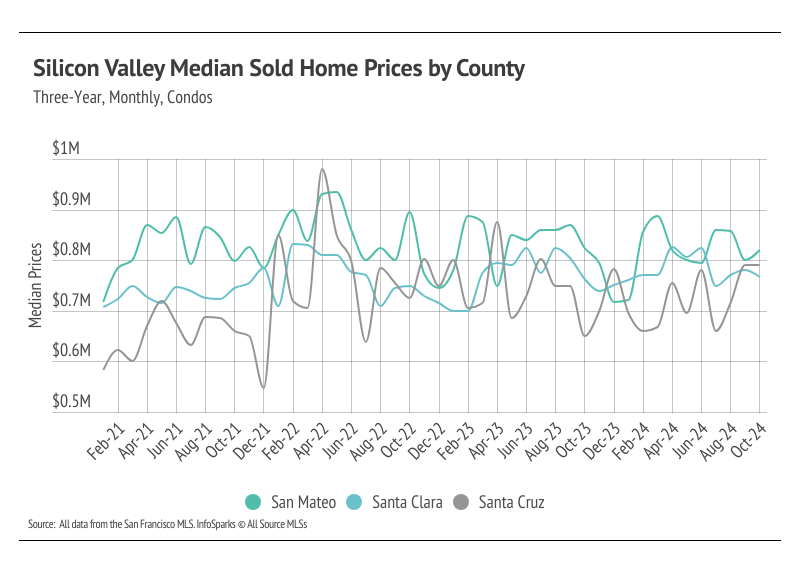

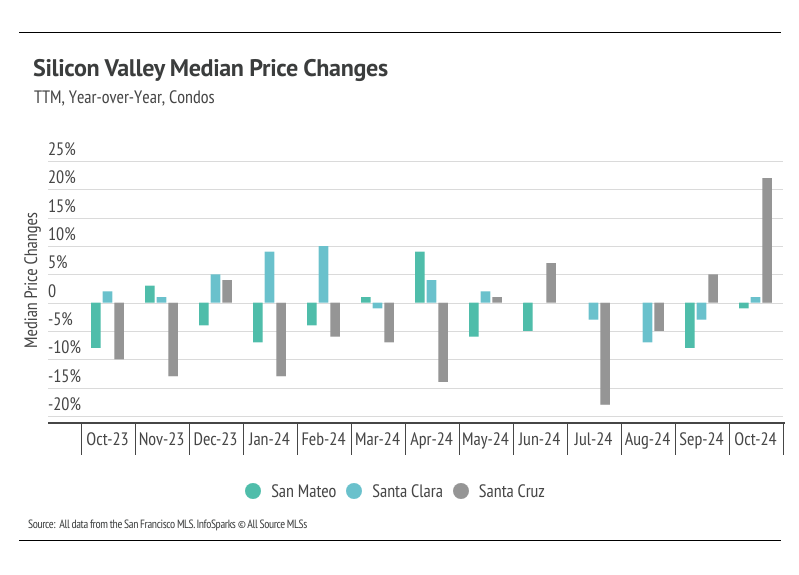

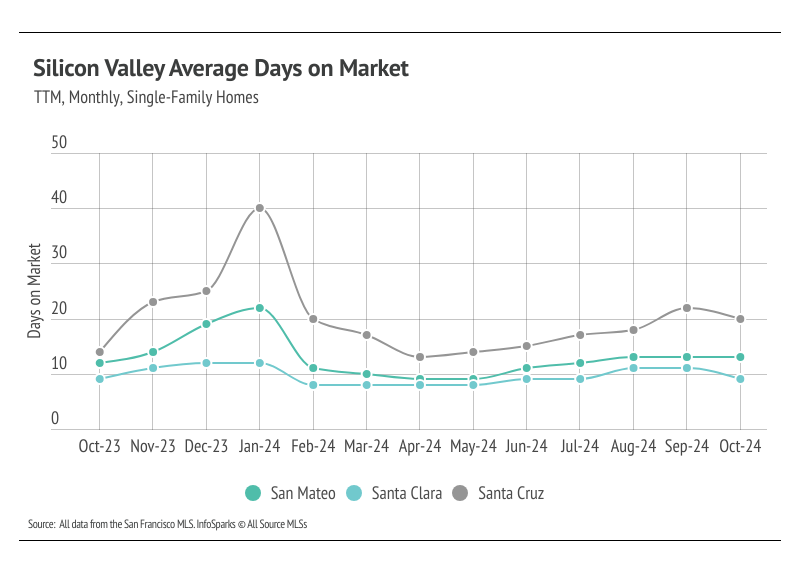

In Silicon Valley, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to January 2023. Low, but growing, inventory and high demand have more than offset the downward price pressure from higher mortgage rates. Year to date, in October, the median single-family home and condo prices rose across counties. Year over year, prices increased most significantly for single-family homes in Santa Clara and Santa Cruz, up 8% and 9%, respectively. Prices typically peak in the summer months, and the mild contraction after the post-summer peak has fallen in line with expectations. Home prices will likely continue to decline slightly for the next three months.

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates near 6% much more than around 7%. Mortgage rates fell significantly from May through September, but rose significantly in October. Now, rates are far closer to 7% than 6%, so we expect sales to slow starting in November.

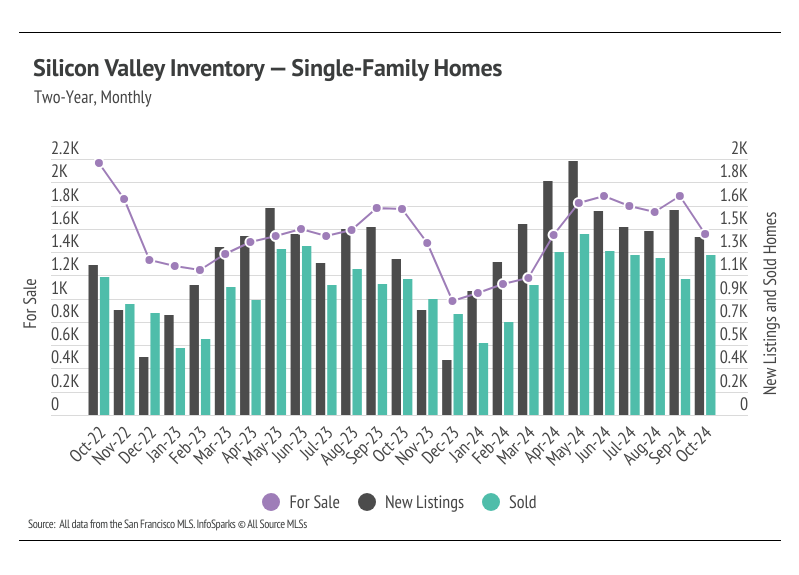

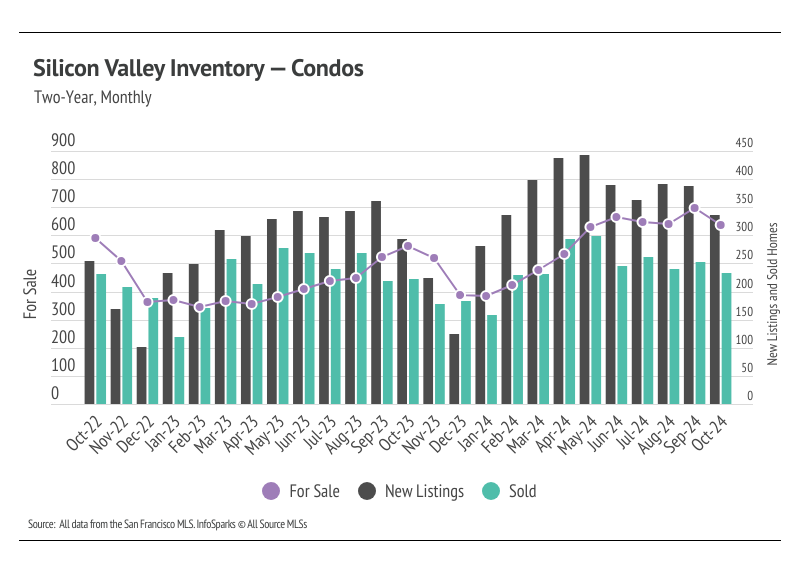

Single-family home sales rose in October, while new listings and inventory fell

The 2024 housing market has looked progressively healthier with each passing month. We’re far enough into the year to know that inventory levels are about as good as we could’ve hoped, although single-family home inventory is still lower than we would like. In 2023, single-family home and condo inventory followed fairly typical seasonal trends, but at significantly depressed levels. Low inventory and fewer new listings slowed the market considerably last year. Even though sales volume this year was similar to last, far more new listings have come to the market, which has allowed inventory to grow. For single-family homes, even though inventory grew meaningfully in the first half of the year, it’s 11% lower year over year.

Typically, inventory begins to increase in January or February, peaking in July or August before declining once again from the summer months to the winter. It’s looking like 2024 inventory, sales, and new listings will resemble historically seasonal patterns, and at more normal levels than last year. However, inventory still increased in September, which is atypical. Falling mortgage rates have brought buyers and sellers back to the market during the time of year the market tends to slow significantly. Sales and homes under contract rose in October, which is fairly normal from a historical standpoint. We expect sales to slow over the next three months.

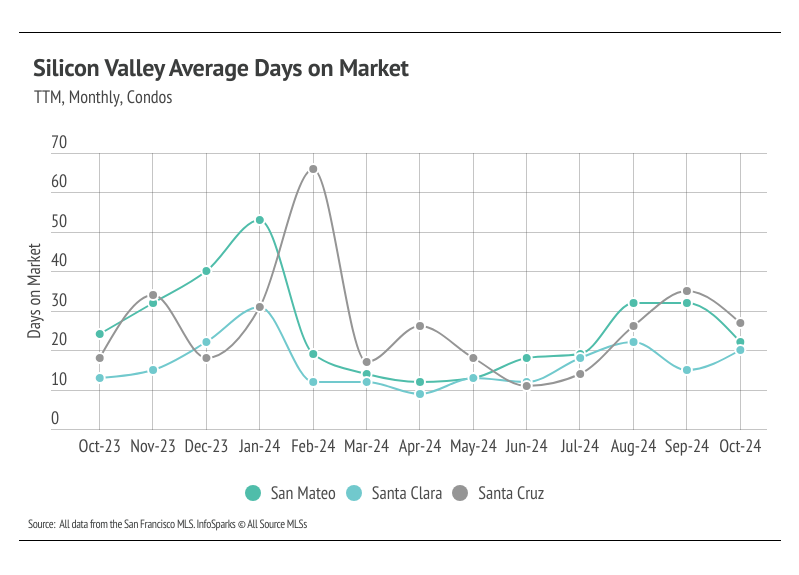

Months of Supply Inventory indicated a sellers’ market in San Mateo and Santa Clara

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Silicon Valley market tends to favor sellers, which is reflected in its low MSI. In 2024, Silicon Valley MSI moved higher, particularly in Q2. In October, MSI dropped across markets. MSI indicated a sellers’ market for single-family homes in San Mateo and Santa Clara and a buyers’ market in Santa Cruz. For condos, San Mateo and Santa Clara favor sellers, and Santa Cruz is more balanced.