If you prefer to bypass The Big Story and jump straight to the Local Market Report, click here.

The Big Story

2024 wrap-up and the year ahead

Quick Take:

- Elevated mortgage rates dominated the housing market in 2024, and 2025 may look similar if inflation starts to ramp up again. Corporations are already increasing prices before more tariffs kick in despite record profits over the past four years.

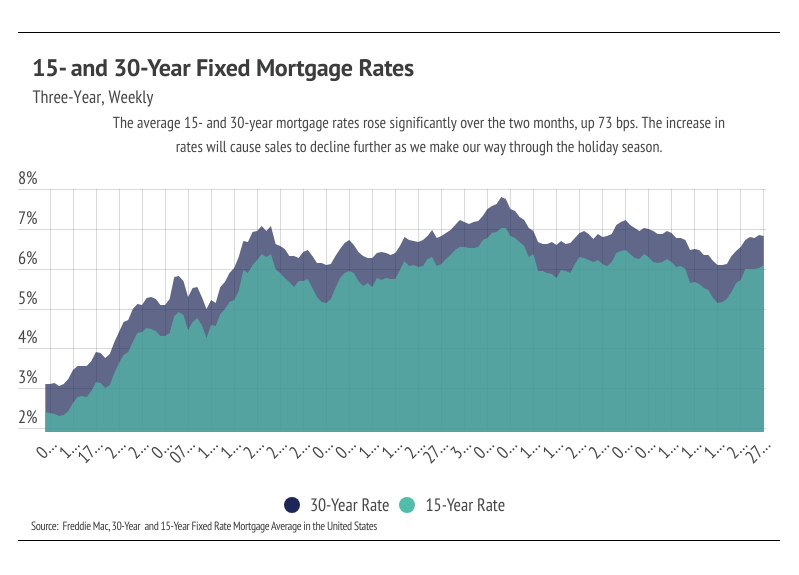

- During November 2024, the average 30-year mortgage rate rose 9 bps, adding to the 64 bps increase in October. Since September 2024, the Fed has cut rates by 75 bps, and we expect another 25 bps cut at their December meeting, barring a significant uptick in November inflation data.

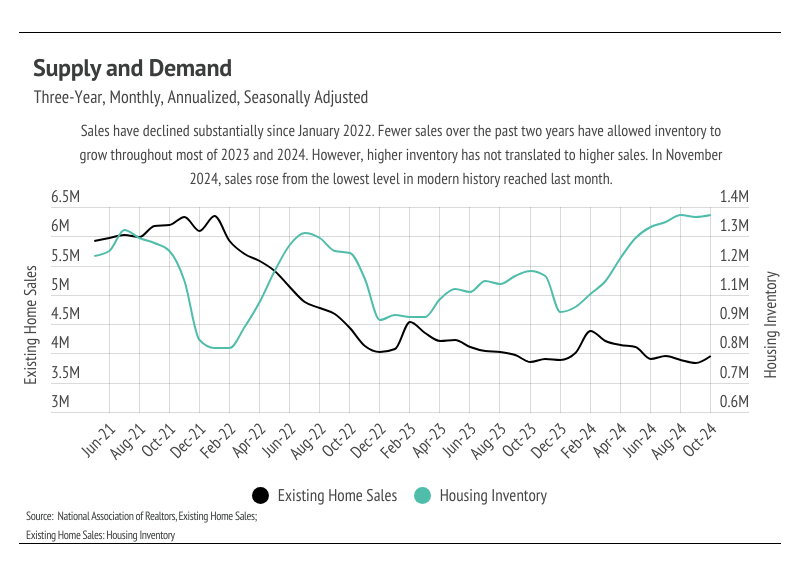

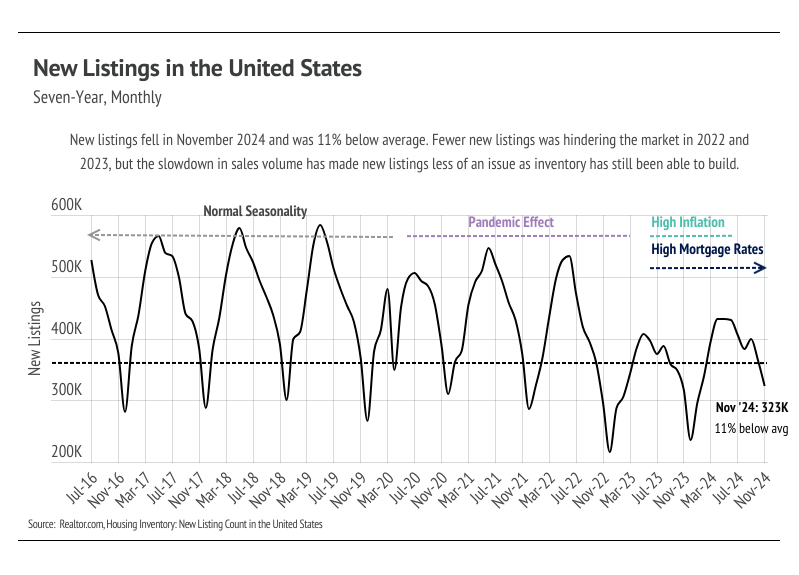

- Sales rose 3.4% month over month, up slightly from last month, which saw the lowest level of sales in modern history. At the same time, inventory rose to its highest level since 2020. Higher inventory levels created more opportunity for sales, although we don’t expect sales volume to increase significantly until spring 2025.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

Higher mortgage rates and higher prices

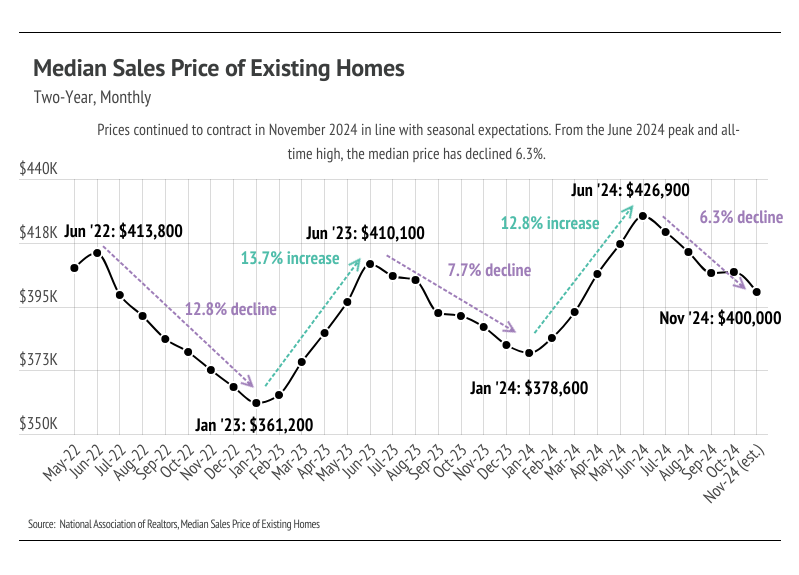

The 2024 housing market was marked by low sales volume, rising inventory, elevated mortgage rates (6.73% on average in 2024), and record high home prices. Low sales volume is easily explained with the combination of high prices, high rates, and the buying boom that happened from June 2020 to June 2022. Record high prices along with a high mortgage rate not seen in 20 years priced buyers out of the market. In June 2024, the median home price reached an all-time high of $426,900 and has since decreased to $400,000, which is in line with the normal seasonal contraction expected in the second half of any calendar year. The all-time high median home price coincided with mortgage rates averaging 6.92%, which equated to the highest monthly mortgage payment ever. Since June, the median home price has declined 6.3%, and we expect prices to continue to decline in December 2024 and January 2025 — the normal seasonal pattern.

As we close out 2024, the economy is doing well by just about every economic metric we typically use: strong job growth, low unemployment, lower inflation, and positive real GDP,to name a few. Interest rates have stayed elevated, which makes the cost of borrowing money higher and, in a sense, slows the economy.. However, even though interest rates have remained higher, the economy hasn’t slowed much while inflation has declined, which was the Fed’s desired effect. As we look forward to 2025, there isn’t much choice but to consider the anticipated economic effects that may come with the administration change.

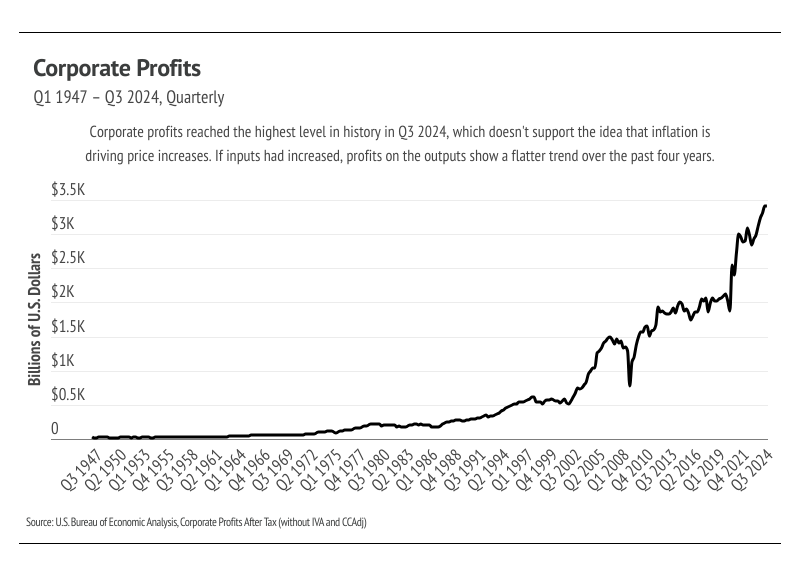

Since last month’s letter, the incoming Trump administration’s stated economic policies haven’t wavered, so tariffs on at least three major trade partners — China, Mexico, and Canada — could go into effect in early 2025. Tariffs raise the price of goods for the importing country and, as corporate profits show, corporations are not willing to accept any downturn in their profits. In Q3 2024, corporate profits reached the highest level in history. For better or worse, we live in a global economy, and the U.S. is a net importer of goods, so corporations will increase prices to offset the tariff (tax) on the goods they import. The U.S. auto industry is particularly vulnerable to tariffs. If car prices rise by 25% almost overnight, sales will drop, causing a spiral of layoffs. Fresh produce is a major agricultural import for the U.S., especially from Mexico and Canada, so food will become more expensive after the tariffs. At the same time, immigrant labor is the backbone of U.S. agriculture and construction, which could be affected by new immigration policies. During Trump’s interview with Kristen Welker, he did not guarantee that tariffs won’t raise prices for the American people — because prices will rise. With inflation comes higher interest rates, so we believe, at best, that mortgage rates will stabilize around 6.5%. At 6.5% interest, a mortgagor pays 32% more per month than the same mortgage at 4%, meaning that fewer buyers will be in the market with a higher interest rate.

In short, there is a high probability that goods and construction costs will become significantly more expensive and that the U.S. will experience a labor shortage in agriculture and construction. Broadly, home prices will probably remain stable in the coming year with lower price growth than we’ve seen in the past four years, but new construction costs could dramatically increase along with delays from fewer workers.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

Quick Take:

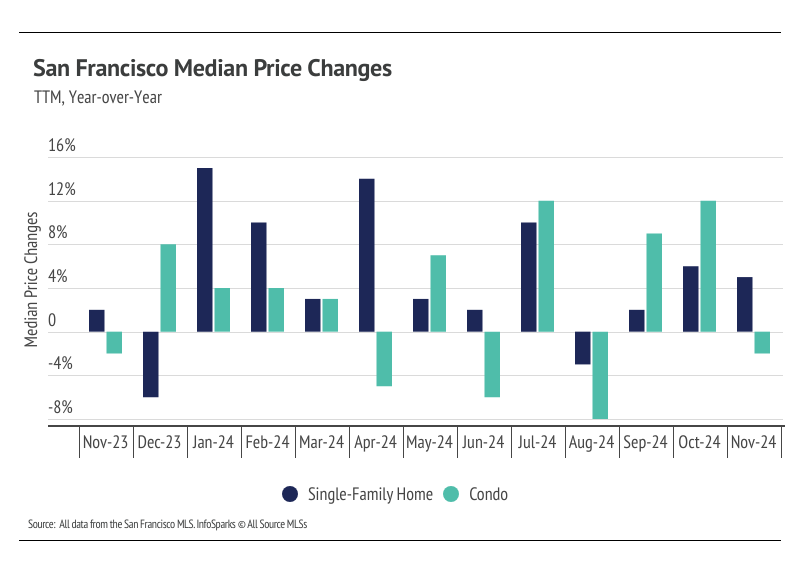

- The median home price fell 8.6% month over month, while condo prices declined 12.0%. We expect prices to contract over the next two months, which is the seasonal norm.

- Total inventory fell 26.5% month over month, as new listings declined far further than sales. We expect inventory to continue to decline and the overall market to slow through January 2025.

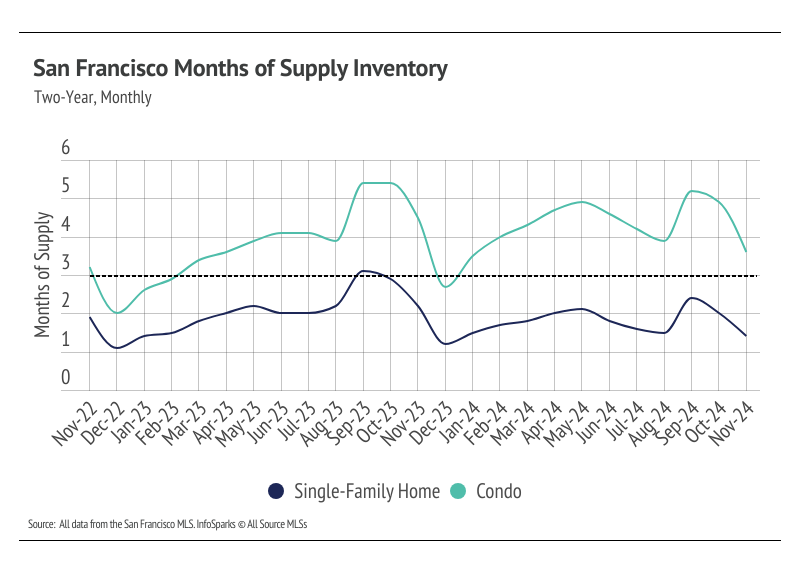

- Months of Supply Inventory declined in October and November. Currently, MSI remains under three months of supply for single-family homes, indicating it’s still a sellers’ market, while condo MSI continues to indicate a buyers’ market.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

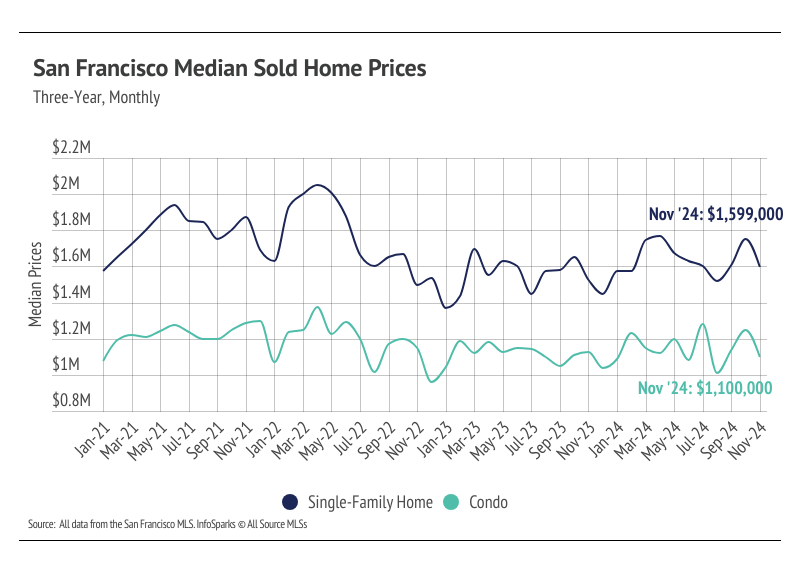

Median home prices declined month over month, typical for November

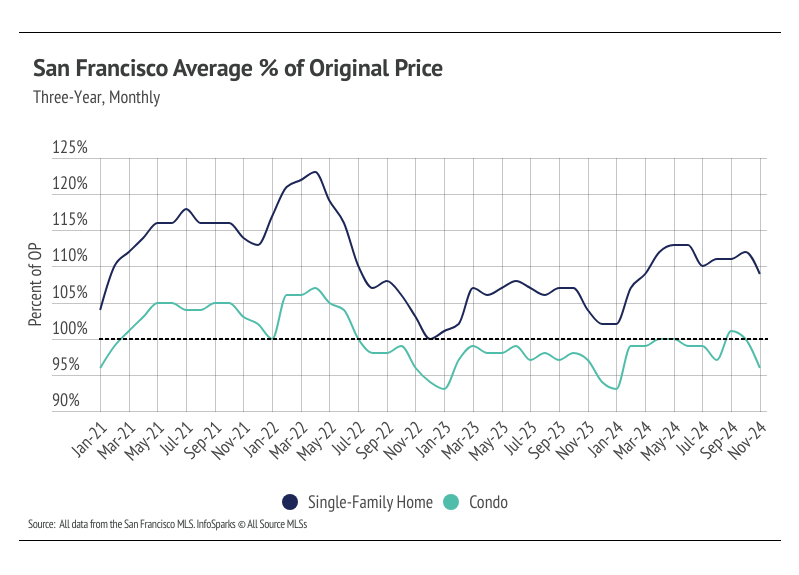

In San Francisco, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to August 2022. Single-family home prices peaked at $2.05 million in April 2022 as mortgage rates rose rapidly; $2 million homes are simply far more affordable with a 4-5% mortgage than a 6-7% mortgage. Because of the relatively high prices of homes in San Francisco, prices had to come down to keep buyers in the market. Since August 2022, the median single-family home and condo prices have hovered around $1.6 million and $1.1 million, respectively. In November, prices were almost exactly in line with those averages. Year over year, the median price was up 5% for single-family homes but down 2% for condos. Inventory is once again so low that rising supply only increases prices as buyers are better able to find the best match.

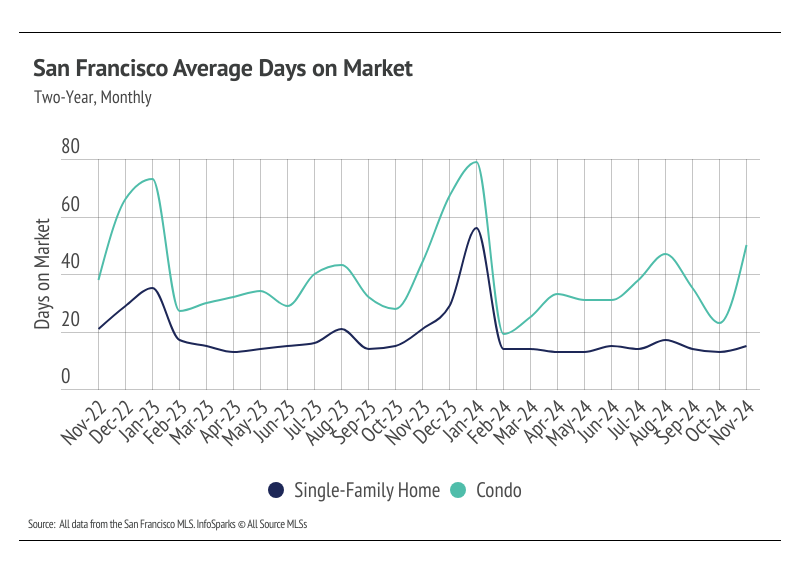

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates near 6% much more than around 7%. Mortgage rates fell significantly from May through September, but rose significantly in October. Now, rates are far closer to 7% than 6%, so we expect sales to slow further.

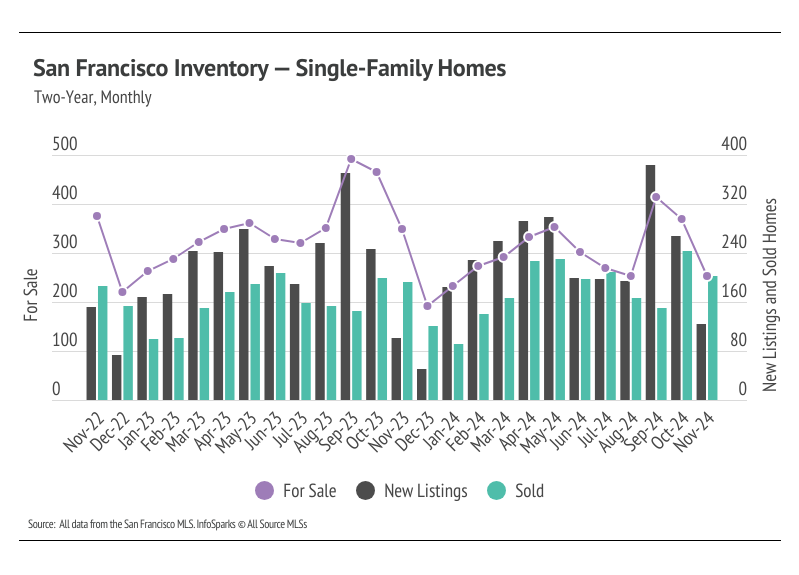

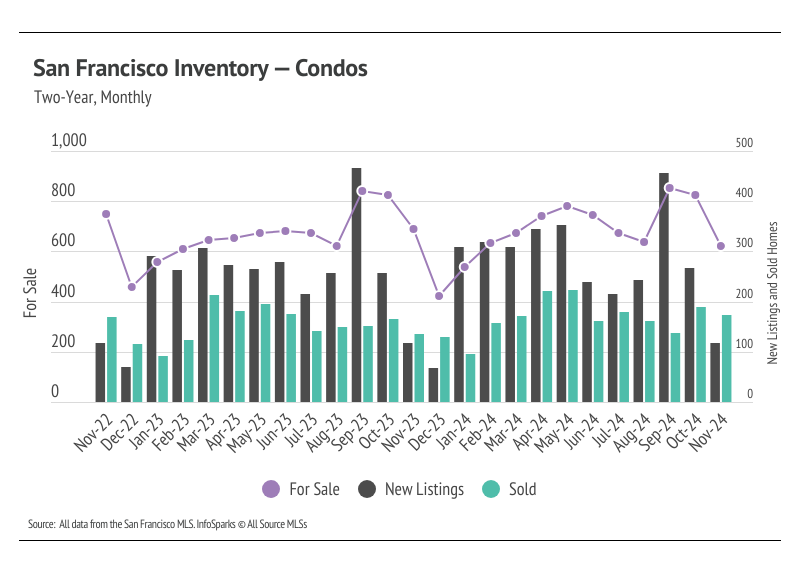

Sales far outpaced new listings in November, causing inventory to drop

Total inventory has trended lower essentially since 2010, but active listings fell precipitously from October 2020 to December 2021, as sales outpaced new listings, before stabilizing to a degree from January 2022 to the present at a depressed level. Low inventory and new listings, coupled with high mortgage rates, have led to a substantial drop in sales and a generally slower housing market. Typically, inventory begins to increase in January or February, peaking in July or August before declining once again from the summer months to the winter. In 2023, sales didn’t resemble the typical seasonal inventory peaks and valleys. It’s looking like 2024 inventory, sales, and new listings will follow historically seasonal patterns, albeit at a depressed level. Supply will remain tight until spring 2025 at the earliest.

In November, sales far outpaced new listings, causing inventory to decline by 27%. Compared to last year, however, new listings are up 22%, which contributed to the year-over-year increase in sales, up 5%.

Months of Supply Inventory in November 2024 indicated a sellers’ market for single-family homes and a buyers’ market for condos

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco housing market tends to favor sellers, which is reflected in its low MSI, at least for single-family homes. MSI has been below three months since October 2023 for single-family homes. From May to August, MSI declined meaningfully. In September, MSI jumped higher as new listings spiked. However, in October, sales jumped and MSI fell. MSI continued to decline in November. Currently, condo MSI indicates a buyers’ market, while single-family home MSI still implies a sellers’ market.