The Big Story

Steady-ish as she goes

Quick Take:

-

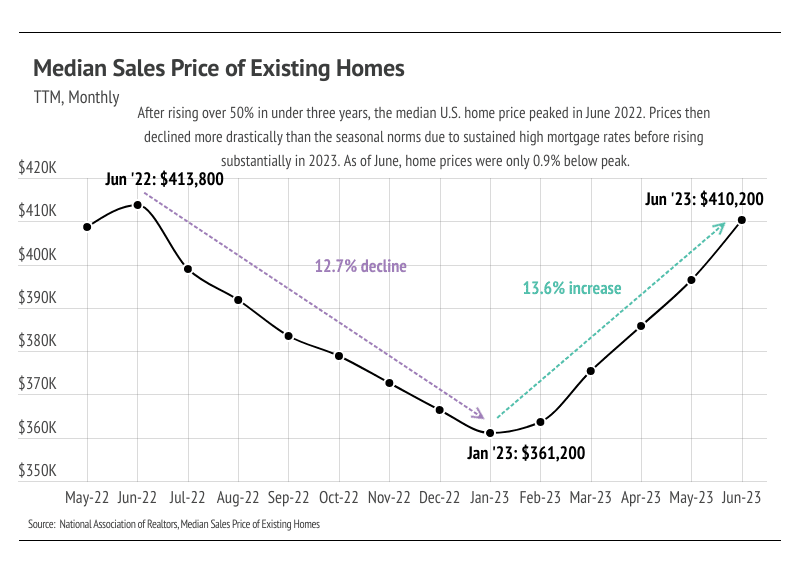

The median home price in the United States landed 1% below the all-time high it reached in June 2022 after appreciating 13.6% in 2023. At the same time, mortgage rates are 1% higher than a year ago, which means the monthly cost of a home is 10% higher than last year.

-

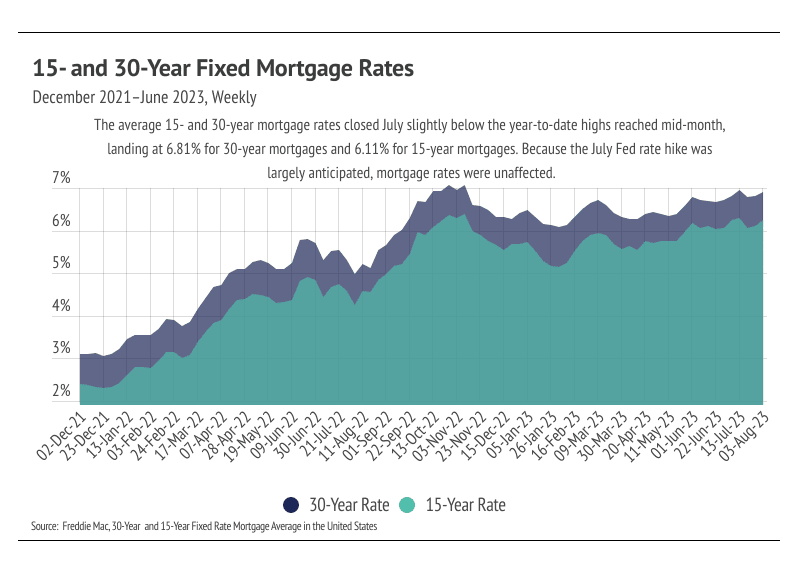

The Fed hiked rates by 0.25% in mid-July to the highest level since 2001, which didn’t impact mortgage rates because the rate increase was expected. However, Fitch unexpectedly downgraded U.S. credit from AAA to AA+ on August 1 and, although we’ve maintained that 30-year mortgage rates would likely hover between 6% and 7% during 2023, the surprise downgrade may push mortgage rates slightly above 7% in the third quarter.

-

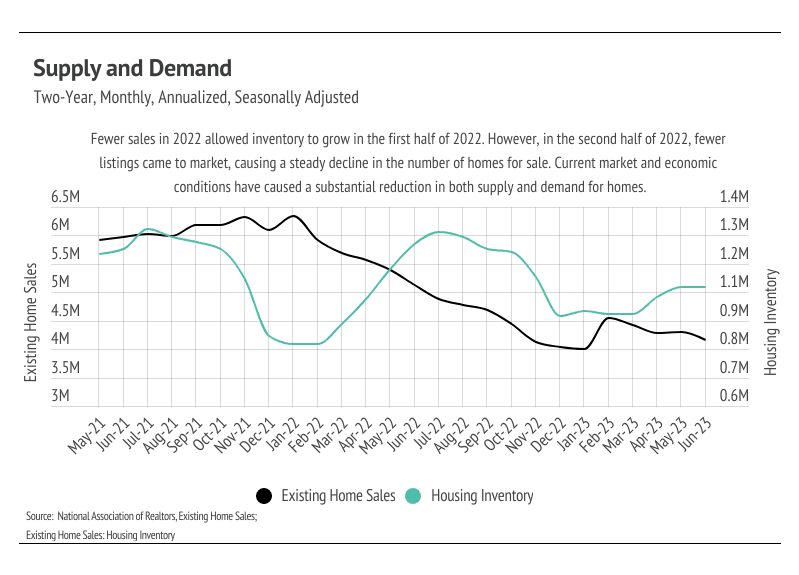

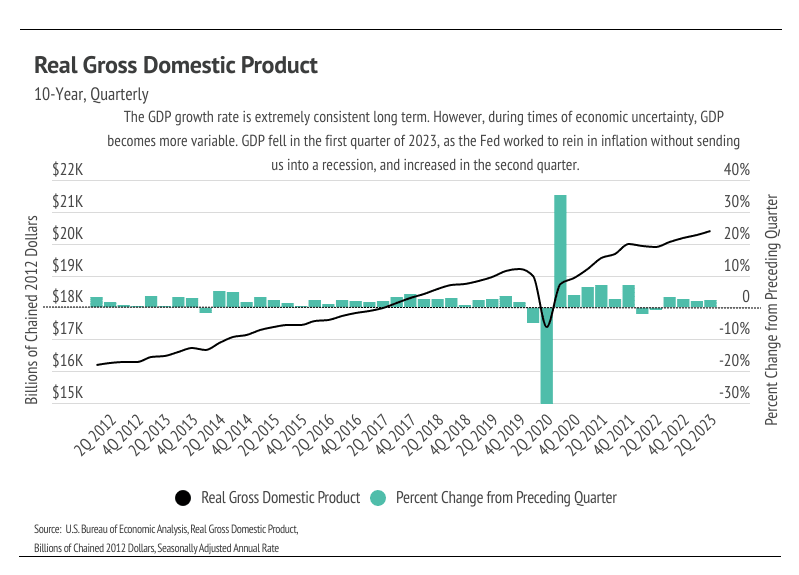

Broadly, the economy is doing well with strong GDP growth, high employment rates and job creation, falling inflation, and growing consumer confidence. Strong economics coupled with a low supply of homes have kept prices climbing, despite sustained elevated mortgage rates.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

The powerhouse of housing

At the start of 2023, the economic consensus resoundingly predicted an impending recession, which has yet to come, and we’re happy to say that consensus has shifted to moderate economic growth. A “soft landing” — reducing inflation without a recession — seems more likely than ever. The economy is far from perfect, but the effect of largely positive economic news eventually leads to a more positive economic outlook from the average person. Job creation and GDP growth in the first half of 2023 have significantly beat expectations. Inflation is declining rapidly, and consumer confidence is the highest it’s been since February 2022. We can largely attribute the bounce in home prices to consumer perception, but consumer perception isn’t the only factor. Home prices certainly rose as recession worries subsided, even in the face of elevated mortgage rates. Supply, or lack thereof, has been the other major factor in the price rebound. Low, but growing inventory allowed for prices to increase quickly.

Housing doesn’t follow an Economics 101 supply-and-demand problem in part because it isn’t a commodity good. Inventory rising from near historic lows actually helps prices because more buyers can find a desirable home. During times of normal seasonality (at least pre-pandemic), inventory, new listings, sales, and prices all increase from January to July and decline from July to January. Any movement away from the hyper-low post-pandemic inventory levels is good for matching buyers with the right home, because buyers like enough selection to find the home they want in their desired location. Price appreciation this year indicates that even though sales are low, buyers are finding the homes they want.

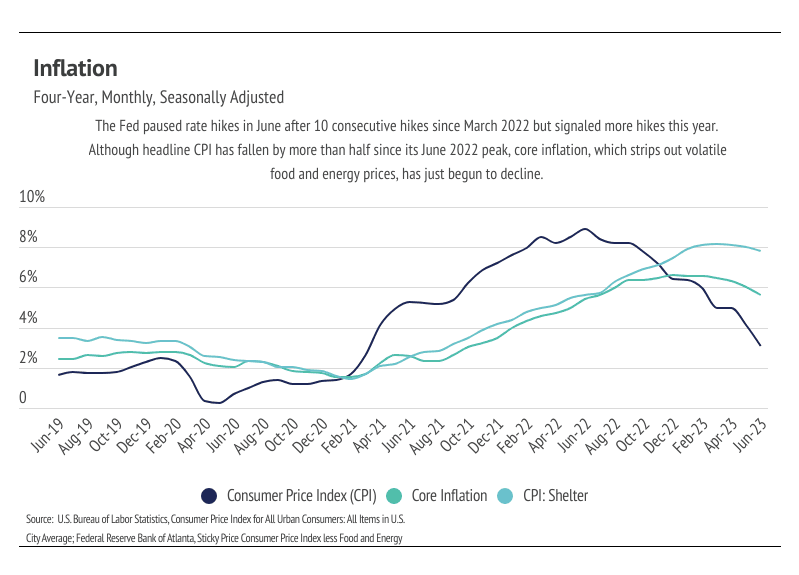

During the Fed’s July meeting, board members decided unanimously to raise the federal funds rate for the 11th time since March 2022 to its highest level since 2001. Although headline inflation (Consumer Price Index, or CPI) is down by nearly two-thirds since it hit 9% last June, core inflation, which removes volatile food and energy prices from the inflation calculation, has only declined 15%. A large component to core inflation is shelter. The CPI for shelter is only down 5% from the March 2023 peak. This isn’t exactly surprising, considering how close prices are to their peak. The Fed stated they would take future rate hikes on a meeting-by-meeting basis. However, this was before Fitch downgraded U.S. credit on August 1. At best, the downgrade will have little to no impact on interest rates, but if it does have any effect, it will move rates higher. The average 30-year mortgage rate hit 6.81% at the end of July and 6.90 the first week of August. Based on weekly data ending August 3, we expect the average 30-year mortgage rate to hover between 6.25% and 7.25%. Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. In general, higher-priced regions (the West and Northeast) have been hit harder by mortgage rate hikes than less expensive markets (the South and Midwest) because of the absolute dollar cost of the rate hikes and the limited ability to build new homes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

-

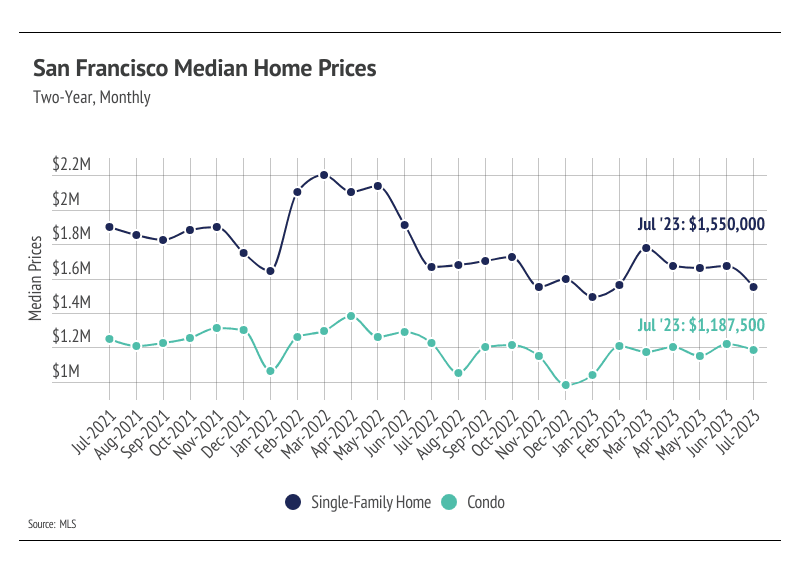

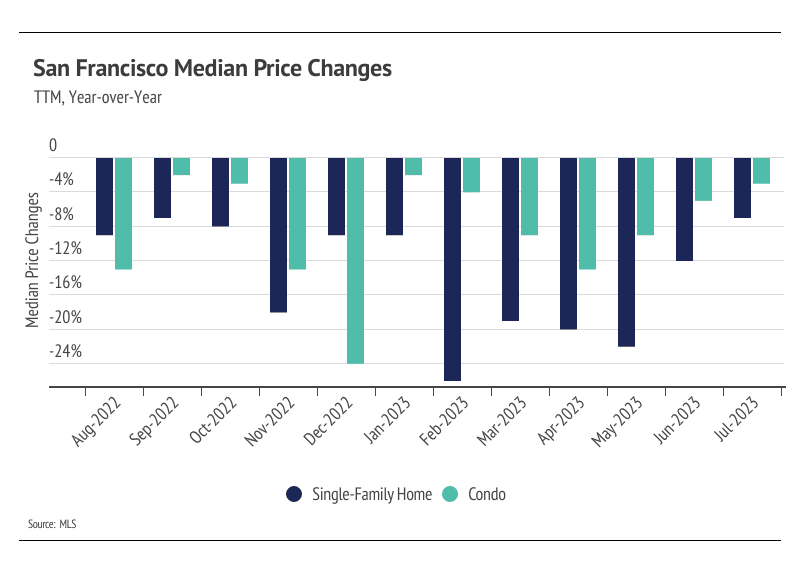

Overall, the median prices have trended lower for the past 16 months. Year to date, single-family home prices are down 3%; condo prices, however, rose 16%.

-

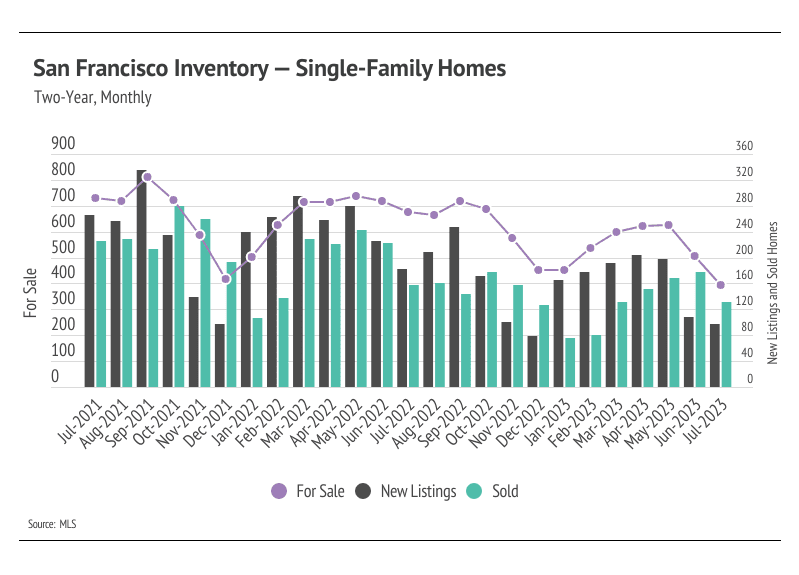

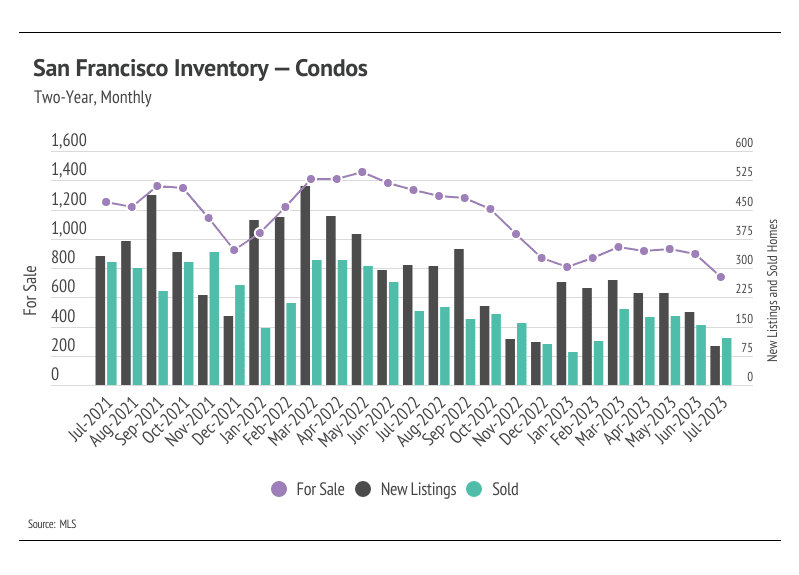

Active listings in San Francisco fell sharply from June to July, reaching record lows for both single-family homes and condos. San Francisco has to grow inventory in a post-pandemic housing market.

-

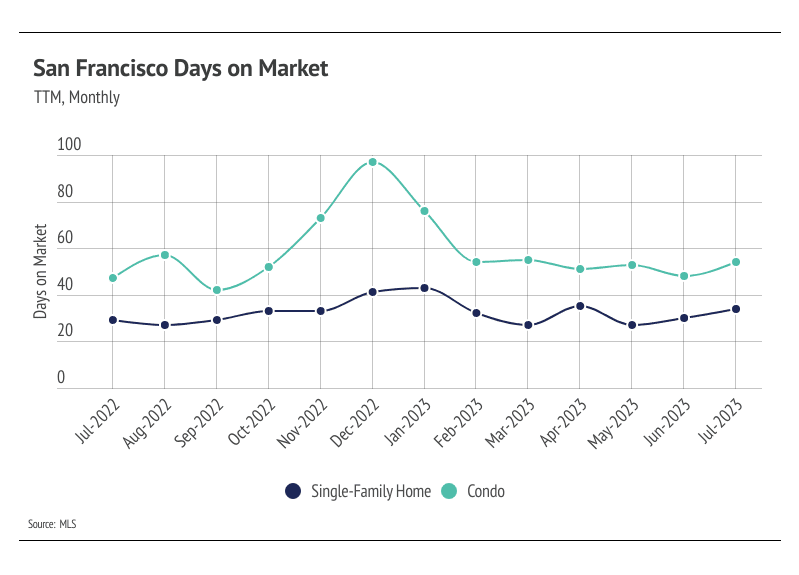

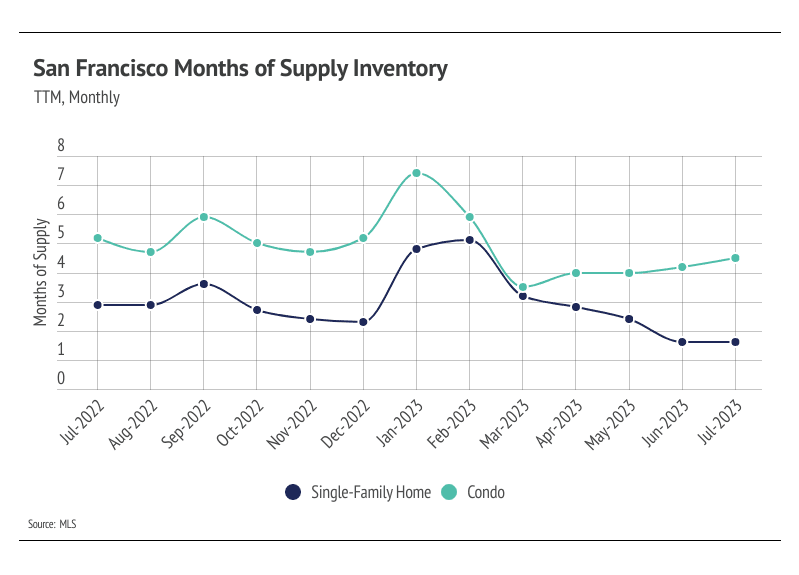

Months of Supply Inventory has declined significantly in 2023 for single-family homes due to lower supply and faster sales, and sellers are receiving a greater percentage of asking price, all of which highlight an increasingly competitive environment for buyers.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Lower prices, inventory, sales, and new listings

In San Francisco, the housing market is always experiencing high demand. But potential homebuyers can’t buy what’s not for sale. The lack of inventory and corresponding lack of sales has skewed price metrics. Homebuyers or homeowners bought or refinanced between mid-2020 and mid-2022 so, for example, the record $2.2 million median home that sold in March 2022 and similar homes simply aren’t on the market. Sales have dropped 42% over the past 24 months, and the average size of sold homes has decreased at the margins. Homeowners who are happy with their home aren’t selling in the current market. All this skews price data lower. San Francisco has supply issues in the best of times, but current inventory levels have almost created a market standstill. Typically, demand begins to decline this time of year, so the record low supply may become less of an issue. However, less of an issue doesn’t mean a non-issue. Quality new listings will certainly be sold quickly, while less desirable homes will sit on the market. This isn’t unusual, but it’s more apparent due to current mortgage rates. Potential homebuyers aren’t nearly as willing to pay a premium for a fixer upper as they were in 2020 and 2021.

Inventory hits all-time low

Inventory has trended lower over the past 12 months, which is far from the seasonal norm. Single-family home and condo inventory hit an all-time low in July, which further highlights how unusual inventory patterns are this year. Typically, inventory peaks in July or August and declines through December or January. Currently, inventory is so low relative to demand that any amount of new listings is good for the market. However, new listings declined rapidly in June and July, which has directly impacted both inventory and sales. The number of home sales is, in part, a function of the number of active listings and new listings coming to market. Since January 2023, sales jumped 62% while new listings fell 52%. As tight inventory levels continue, sellers are gaining negotiating power. In January 2023, the average seller received 96% of list price compared to 99% of list in July. Inventory will almost certainly remain historically low for the year, and the market will remain competitive in the third quarter.

Months of Supply Inventory remained low in July

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco market tends to favor sellers, at least for single-family homes, which is reflected in its low MSI. However, we’ve seen over the past 12 months that this isn’t always the case. MSI indicated that single-family homes and condos began the year in a buyers’ market. MSI has declined sharply since January for both single-family homes and condos, indicating that the climate has shifted from a buyers’ market to a sellers’ market for single-family homes and a balanced market for condos. The sharp drop in MSI occurred due to the higher proportion of sales relative to active listings and less time on the market.