The Big Story

Mortgage rates are plummeting, but how far will they fall?

Quick Take:

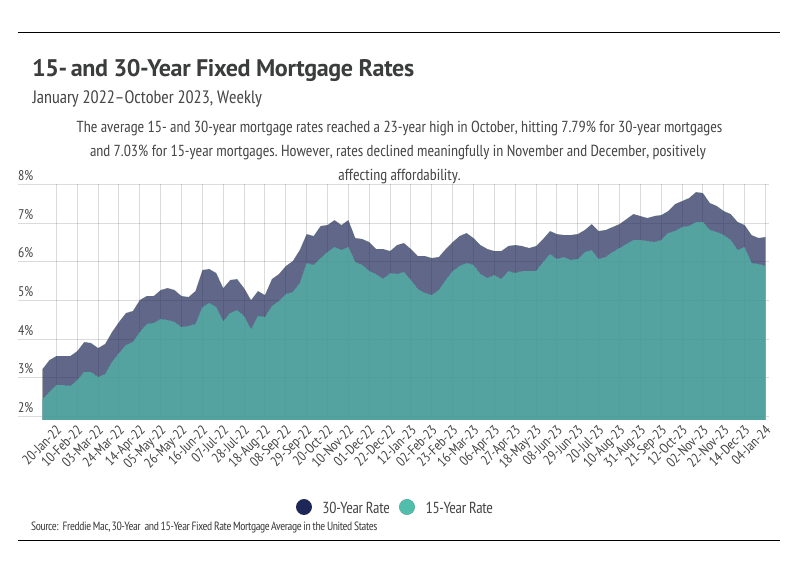

- The average 30-year mortgage rate fell 1.18% in the last two months of 2023, which is a significant drop from the 23-year high reached at the end of October 2023 and cut the cost of financing by 11%.

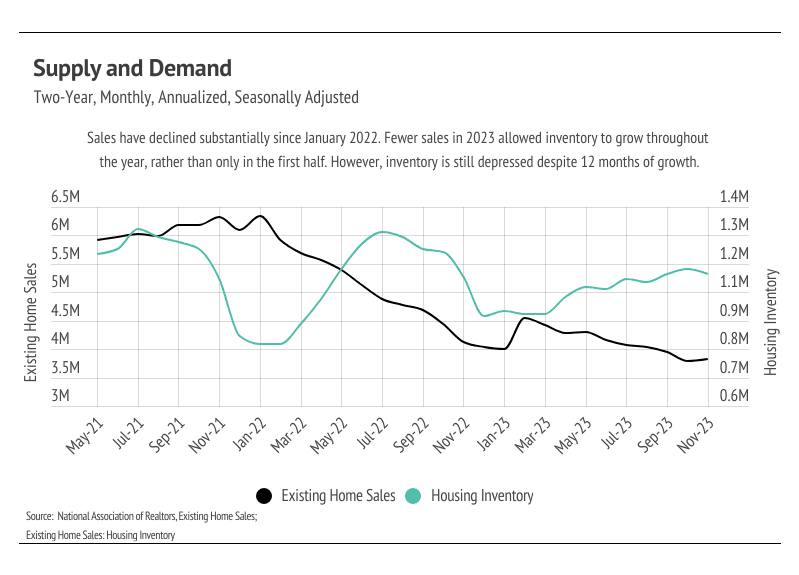

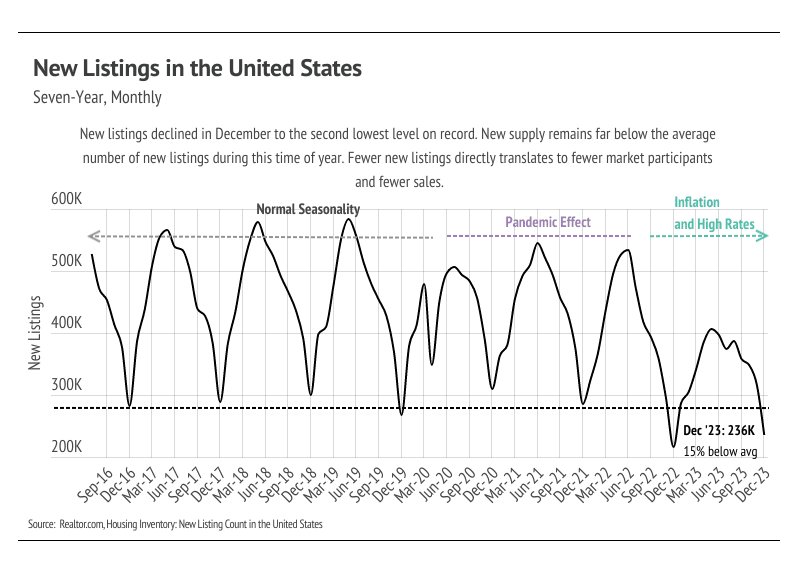

- Although sales are still down 7% year over year, they rose 1% month over month, ending a five-month streak of decline. Even though inventory rose for most of 2023, supply is still tight, which prevented home prices from falling meaningfully in the second half of the year.

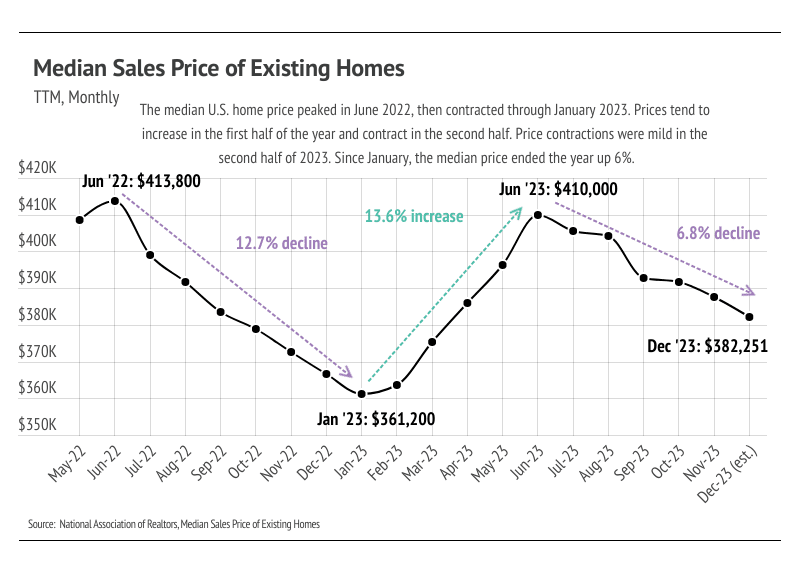

- The median home price declined approximately 7% in the second half of 2023, about half as much as the 13% decline in the second half of 2022. If the Fed begins to cut rates as soon as March, which financial markets are predicting, 30-year mortgage rates could easily fall another point, bringing buyers and sellers back to market in the spring and summer.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

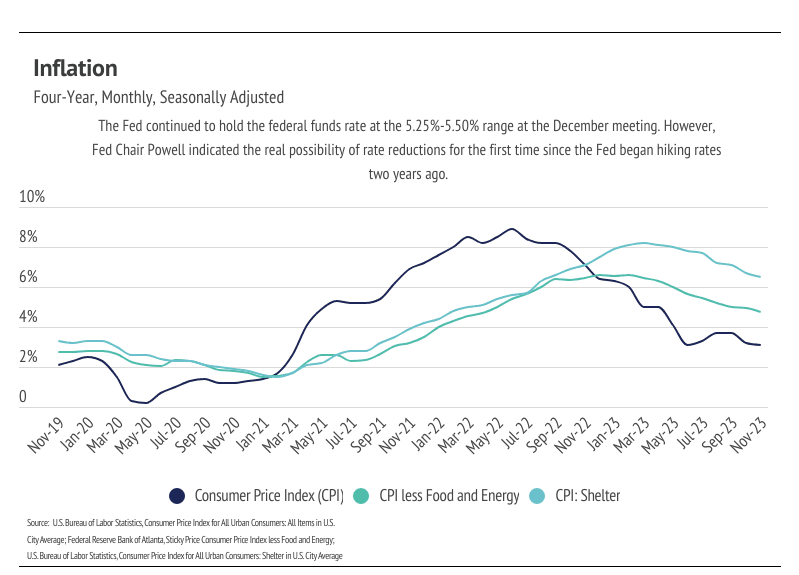

A 1.18% mortgage rate drop matters … a lot

The next Fed meeting isn’t until the end of January, but financial markets have already made major assumptions about what the Fed will do in 2024. In the December 2023 meeting, Fed members indicated there would likely be three 0.25% cuts to the fed funds rate by the end of 2024, but they noted a high degree of uncertainty. Markets took this news and made their own conclusions. As of January 3, 2024, fed funds futures traders (the people who make a lot of money being right about where rates will go) expect the Fed to cut the federal funds rate by a quarter point six times in 2024. Currently, the fed funds rate is between 5.25% and 5.50%.

In any case, for the >70% of homebuyers who finance their purchases with mortgages, rate cuts are very good news, as shown by the month-over-month increase in sales. However, even before the December meeting, economic indicators seemed favorable for rate cuts, which, in part, caused mortgage rates to drop 0.57% in November 2023 — a significant fall from the 23-year high of 7.79% in October. Markets move a lot faster than the Fed, and the 1.18% mortgage rate drop in November and December brings to mind the trends we saw in the first quarter of 2022. In December 2021, Fed Chair Jerome Powell stated that they were increasing rates beginning in March 2022, but mortgage rates increased by about a point in the first quarter even before the Fed made any changes.

The 1.18% decline in mortgage rates has set the stage for a much busier spring and summer season, although we still expect a relatively slow first quarter. Interest rates are still too high for potential buyers and sellers to rush back to the market, especially when they expect further rate cuts. However, if mortgage rates were to drop another point to around 5.5%, a huge number of participants would jump back into the market. Remember that every 1% decrease in interest rates roughly equates to a 10% decrease in monthly financing costs. The inverse is also true, which is why rates have priced buyers out of the market and remain the primary cause of the market slowdown over the past two years.

Because inventory hasn’t grown, prices haven’t meaningfully declined. In fact, home prices currently fall only 8% below the June 2022 all-time high, which means that any savings will likely come from rate drops. Even if a significant number of sellers come to market, there’s enough pent-up demand that inventory won’t be able to grow enough for prices to stagnate or decline outside of normal seasonal trends. On top of that, home prices almost always appreciate. In other words, betting on home prices to decline is statistically similar to betting on 00 in roulette. Nationally, the median price will likely hit a new all-time high in June 2024. The National Association of Realtors’ Chief Economist Lawrence Yun recently remarked that home prices keep marching higher, and only a dramatic rise in supply will dampen price appreciation.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. In general, higher-priced regions (the West and Northeast) have been hit harder by mortgage rate hikes than less expensive markets (the South and Midwest) because of the absolute dollar cost of the rate hikes and limited ability to build new homes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

Quick Take:

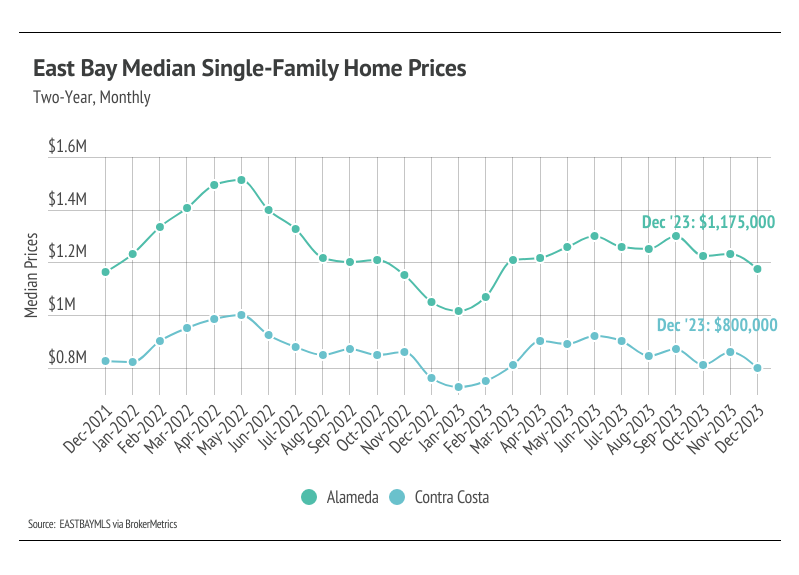

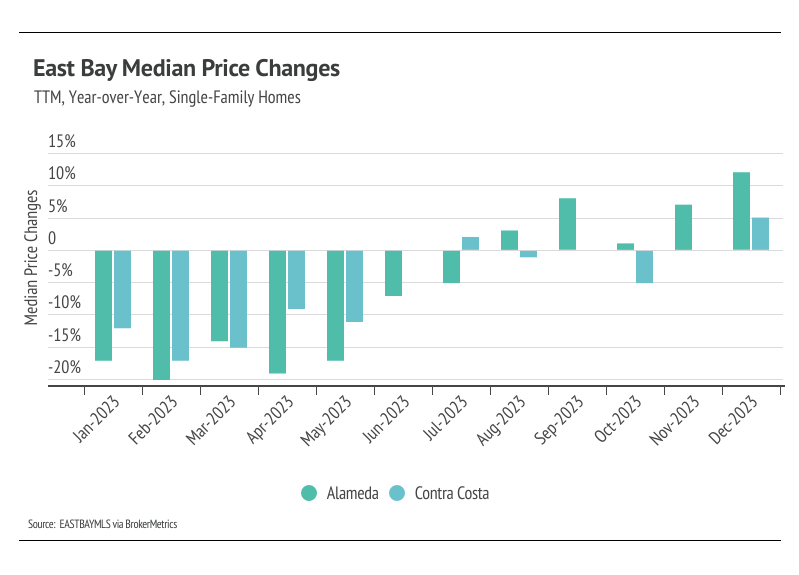

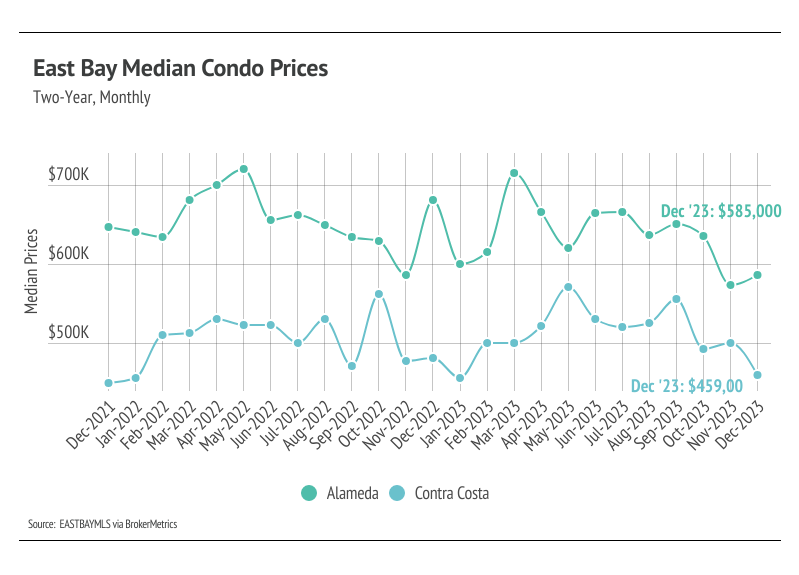

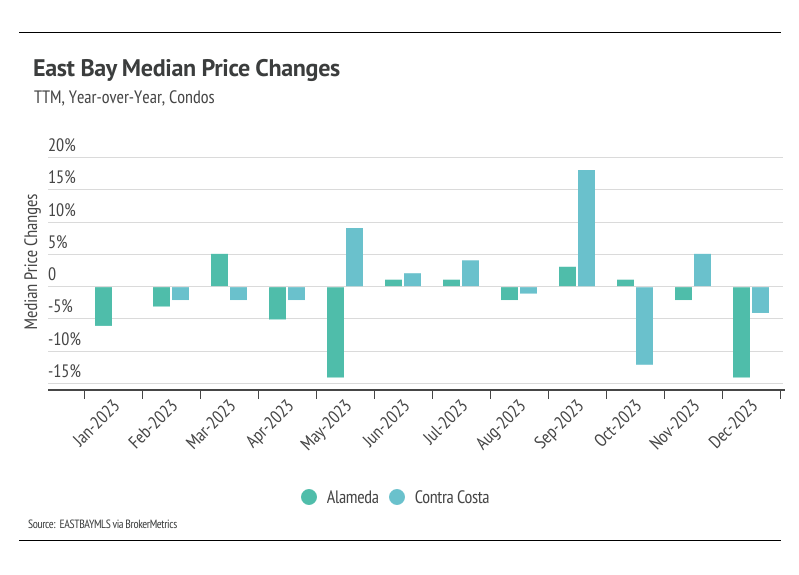

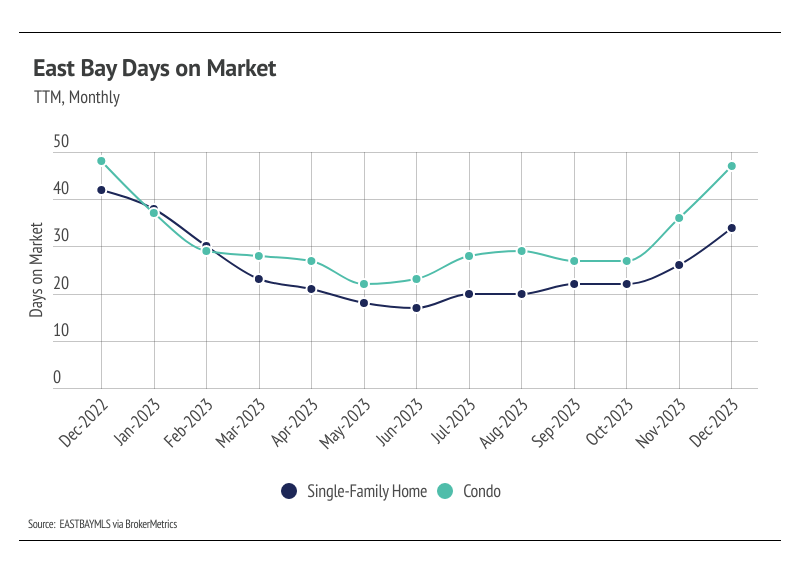

- Median single-family home prices declined from November to December, which is normal this time of year. However, single-family home prices appreciated year over year, up 11.9% in Alameda and 5.3% in Contra Costa. Condo prices fell in the East Bay year over year.

- Active listings in the East Bay fell 27% month over month, which is typical this time of year when new listings tend to decline significantly. As mortgage rates drop, we will likely see more new listings in the first quarter, which should help alleviate some excess demand.

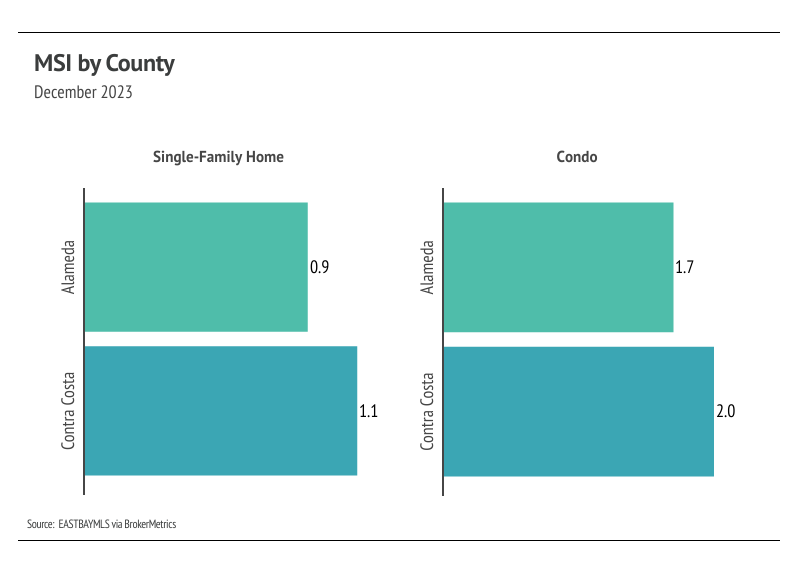

- Months of Supply Inventory declined significantly in December, as sales outpaced new listings, indicating the market firmly favors sellers as we enter the new year.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Median single-family home prices close 2023 up year over year

In the East Bay, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from May 2022 to January 2023. Month over month, in December, the median single-family home price declined 4.5% in Alameda and 7.0% in Contra Costa. Condo prices were more mixed, with a 2.1% increase in Alameda and an 8.6% decrease in Contra Costa. We expect prices to remain fairly stable in the winter months, but as interest rates decline and more sellers come to the market, prices will almost certainly rise in the first half of 2024. More homes must come to the market in the spring and summer to get anything close to a healthy market.

High mortgage rates soften both supply and demand, so ideally, as rates fall, far more sellers will come to the market. Rising demand can only do so much for the market if there isn’t supply to meet it. Unlike 2023 inventory, 2024 inventory has a much better chance of following more typical seasonal patterns.

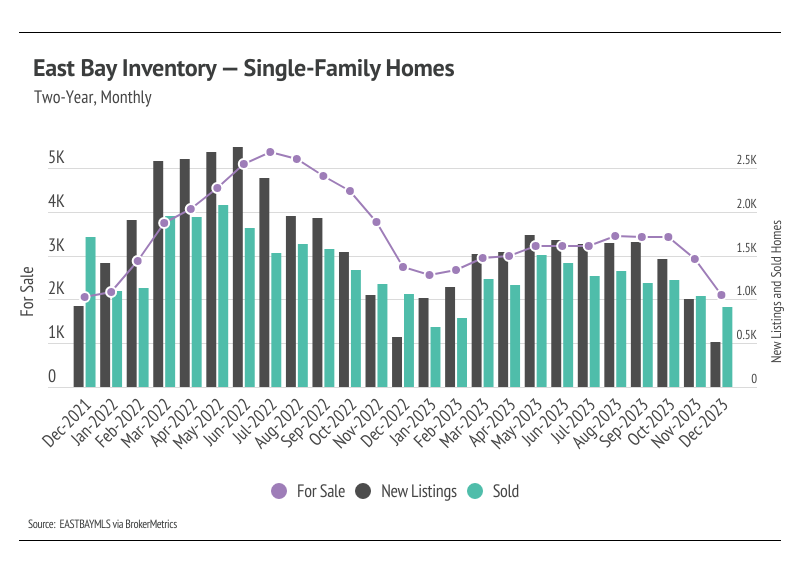

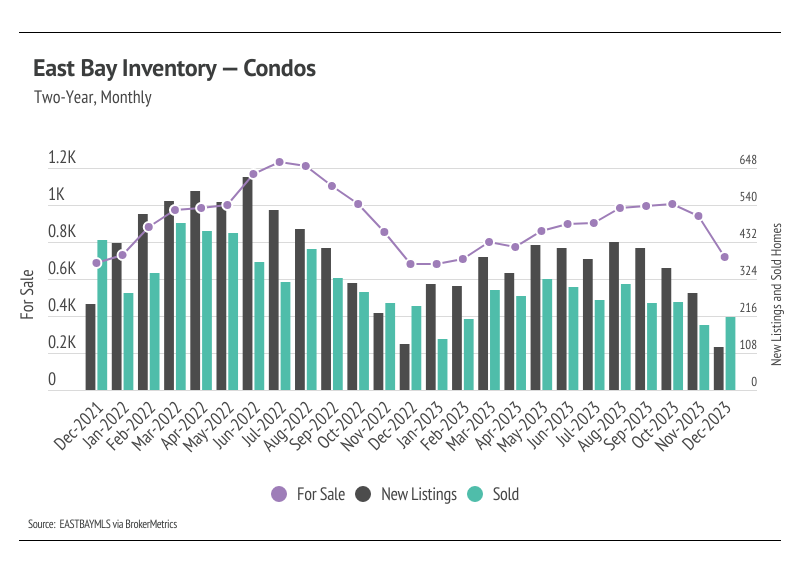

Inventory, sales, and new listings declined month over month

Single-family home and condo inventory barely increased at all last year, which is far from the seasonal norm. In 2023, inventory didn’t have anything resembling the typical sine wave, since far fewer sellers came to the market, especially in the first half of the year, and the low inventory and fewer new listings slowed the market considerably. New listings have been exceptionally low, so the little inventory growth last year was driven by softening demand. Typically, inventory peaks in July or August and declines through December or January. However, in 2023, inventory peaked in October, further highlighting the atypical supply trend. In November and December, inventory, sales, and new listings dropped, which is normal this time of year. With the current low inventory levels, the number of new listings coming to market is a significant predictor of sales. Month over month, new listings fell 50% and sales declined 8%. Total inventory is down 18% year over year.

As demand slows, buyers are gaining more negotiating power and paying less than they were during the busier summer season. In June 2023, the average seller received 105% of list price, compared to 101% of list in December. However, on average, buyers paid 4% more in December 2023 than December 2022. Inventory will almost certainly remain historically low for the next few months, and buyer competition will ramp up meaningfully in the spring, which will drive price appreciation.

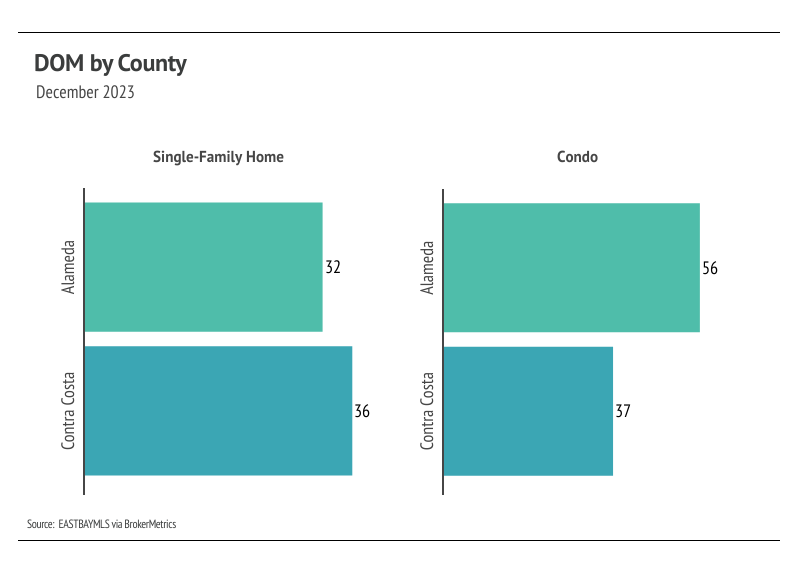

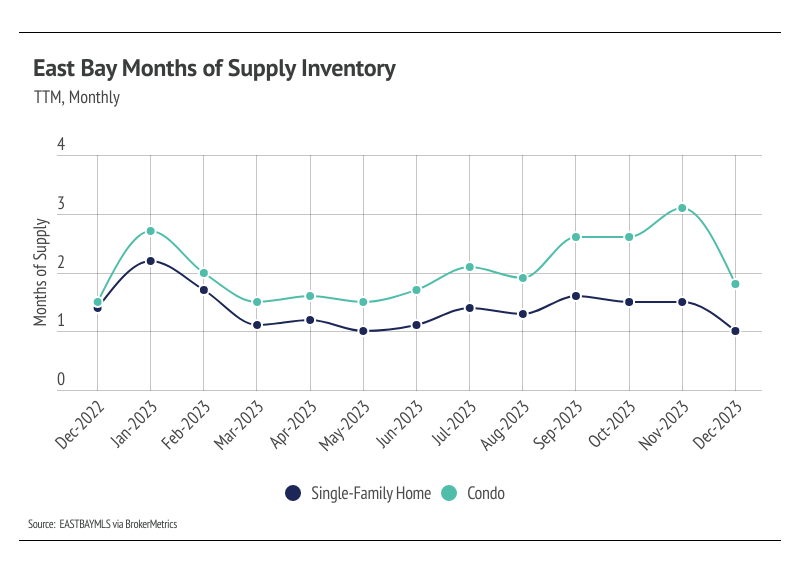

Months of Supply Inventory in December 2023 indicated a sellers’ market

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The East Bay market tends to favor sellers, which is reflected in its low MSI. MSI fell sharply in the first quarter of 2023 before gently trending higher from May to November. In December, MSI declined sharply. Currently, the East Bay housing market favors sellers.