If you prefer to bypass The Big Story and jump straight to the Local Market Report, click here.

The Big Story

2024 wrap-up and the year ahead

Quick Take:

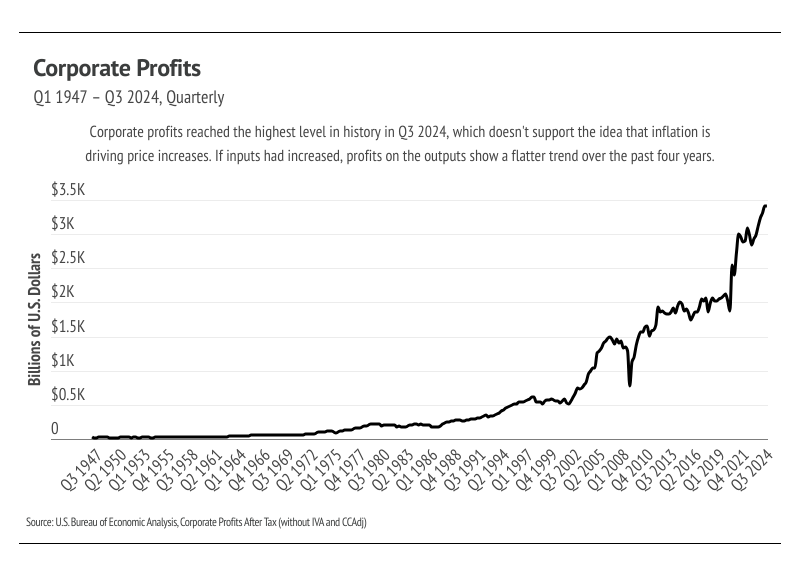

- Elevated mortgage rates dominated the housing market in 2024, and 2025 may look similar if inflation starts to ramp up again. Corporations are already increasing prices before more tariffs kick in despite record profits over the past four years.

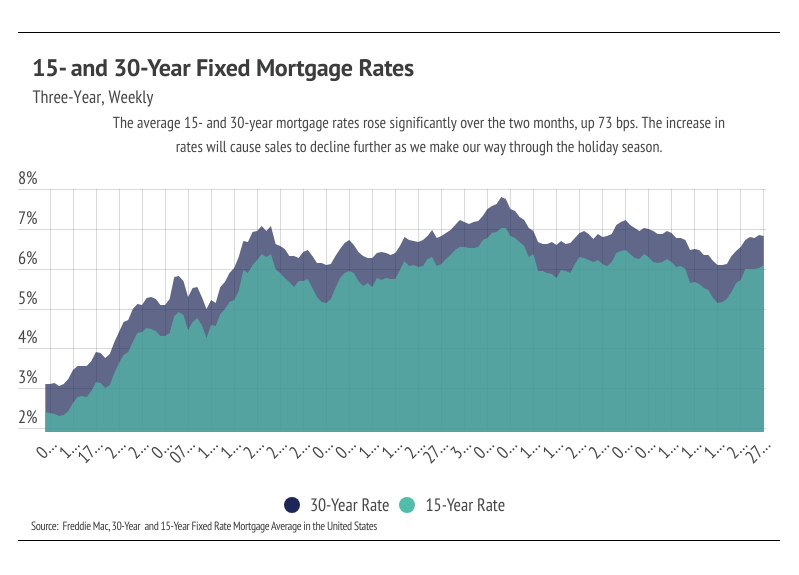

- During November 2024, the average 30-year mortgage rate rose 9 bps, adding to the 64 bps increase in October. Since September 2024, the Fed has cut rates by 75 bps, and we expect another 25 bps cut at their December meeting, barring a significant uptick in November inflation data.

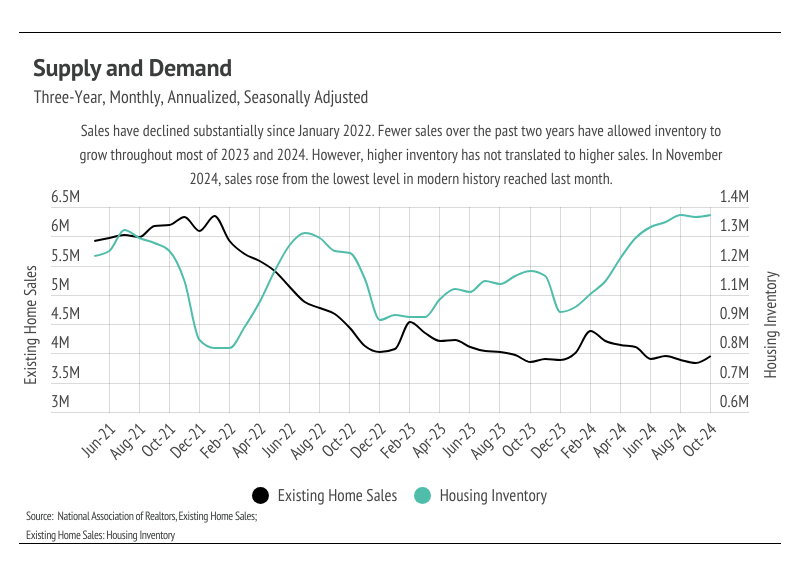

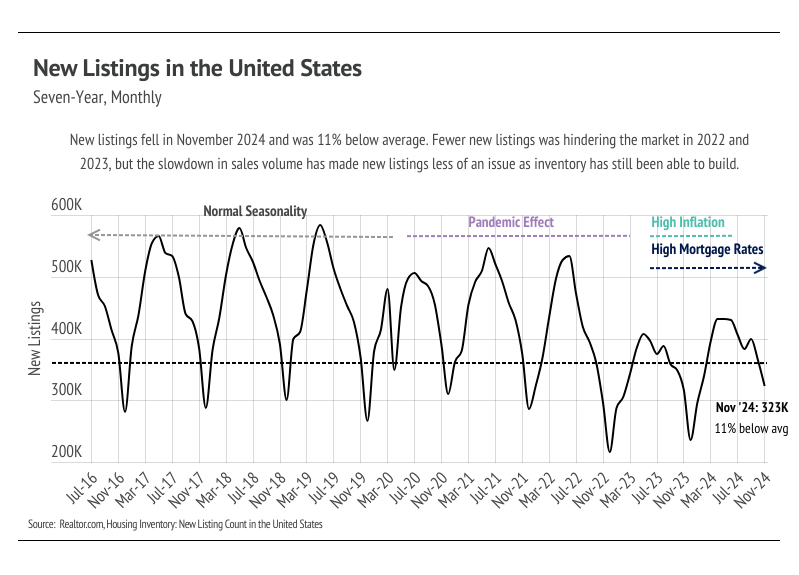

- Sales rose 3.4% month over month, up slightly from last month, which saw the lowest level of sales in modern history. At the same time, inventory rose to its highest level since 2020. Higher inventory levels created more opportunity for sales, although we don’t expect sales volume to increase significantly until spring 2025.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

Higher mortgage rates and higher prices

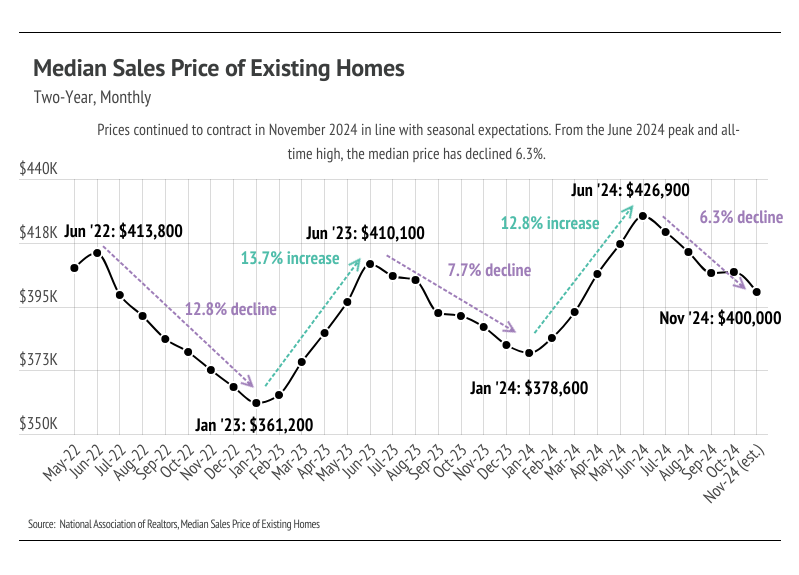

The 2024 housing market was marked by low sales volume, rising inventory, elevated mortgage rates (6.73% on average in 2024), and record high home prices. Low sales volume is easily explained with the combination of high prices, high rates, and the buying boom that happened from June 2020 to June 2022. Record high prices along with a high mortgage rate not seen in 20 years priced buyers out of the market. In June 2024, the median home price reached an all-time high of $426,900 and has since decreased to $400,000, which is in line with the normal seasonal contraction expected in the second half of any calendar year. The all-time high median home price coincided with mortgage rates averaging 6.92%, which equated to the highest monthly mortgage payment ever. Since June, the median home price has declined 6.3%, and we expect prices to continue to decline in December 2024 and January 2025 — the normal seasonal pattern.

As we close out 2024, the economy is doing well by just about every economic metric we typically use: strong job growth, low unemployment, lower inflation, and positive real GDP,to name a few. Interest rates have stayed elevated, which makes the cost of borrowing money higher and, in a sense, slows the economy.. However, even though interest rates have remained higher, the economy hasn’t slowed much while inflation has declined, which was the Fed’s desired effect. As we look forward to 2025, there isn’t much choice but to consider the anticipated economic effects that may come with the administration change.

Since last month’s letter, the incoming Trump administration’s stated economic policies haven’t wavered, so tariffs on at least three major trade partners — China, Mexico, and Canada — could go into effect in early 2025. Tariffs raise the price of goods for the importing country and, as corporate profits show, corporations are not willing to accept any downturn in their profits. In Q3 2024, corporate profits reached the highest level in history. For better or worse, we live in a global economy, and the U.S. is a net importer of goods, so corporations will increase prices to offset the tariff (tax) on the goods they import. The U.S. auto industry is particularly vulnerable to tariffs. If car prices rise by 25% almost overnight, sales will drop, causing a spiral of layoffs. Fresh produce is a major agricultural import for the U.S., especially from Mexico and Canada, so food will become more expensive after the tariffs. At the same time, immigrant labor is the backbone of U.S. agriculture and construction, which could be affected by new immigration policies. During Trump’s interview with Kristen Welker, he did not guarantee that tariffs won’t raise prices for the American people — because prices will rise. With inflation comes higher interest rates, so we believe, at best, that mortgage rates will stabilize around 6.5%. At 6.5% interest, a mortgagor pays 32% more per month than the same mortgage at 4%, meaning that fewer buyers will be in the market with a higher interest rate.

In short, there is a high probability that goods and construction costs will become significantly more expensive and that the U.S. will experience a labor shortage in agriculture and construction. Broadly, home prices will probably remain stable in the coming year with lower price growth than we’ve seen in the past four years, but new construction costs could dramatically increase along with delays from fewer workers.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

Quick Take:

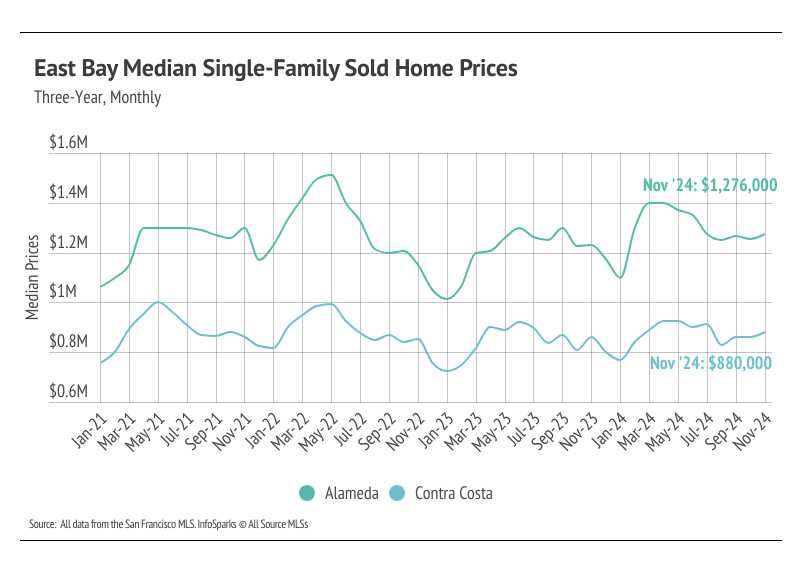

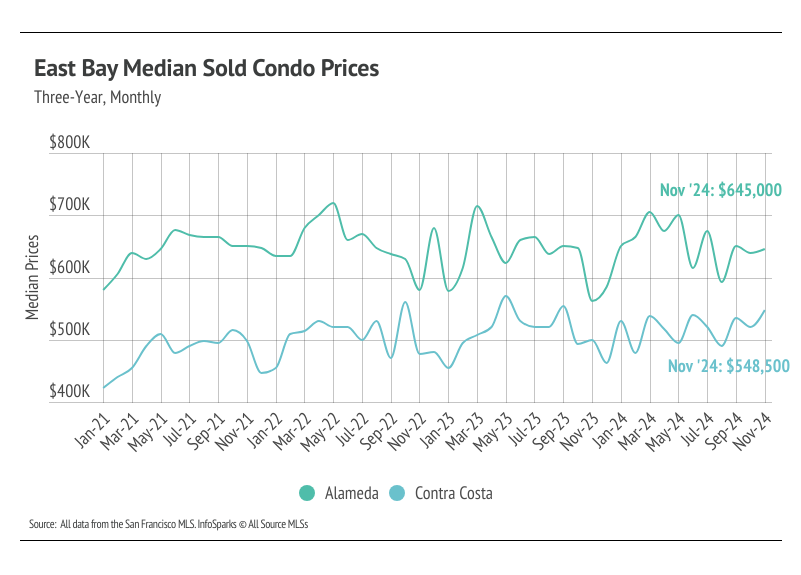

- Median price movements were mixed across markets and dwelling types in the Bay Area. The East Bay was the only region where prices rose month over month for both single-family homes and condos. We expect prices to contract over the next two months across the Bay Area, which is the seasonal norm.

- Total inventory in the Bay Area declined significantly, as sales far outpaced new listings. We expect inventory to decline and the overall market to slow over the next two months.

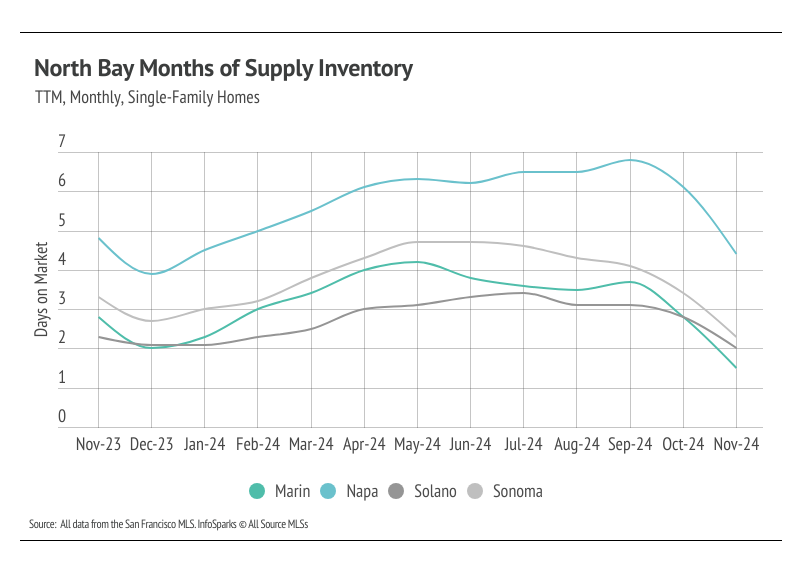

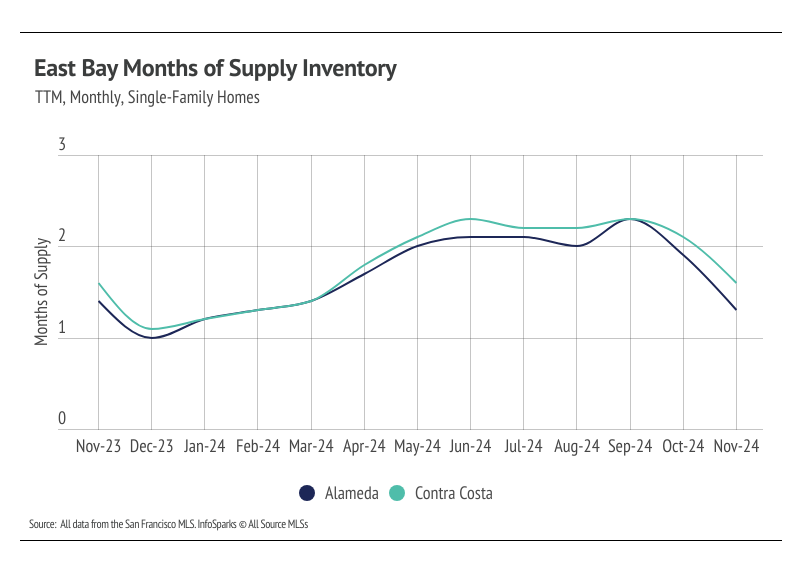

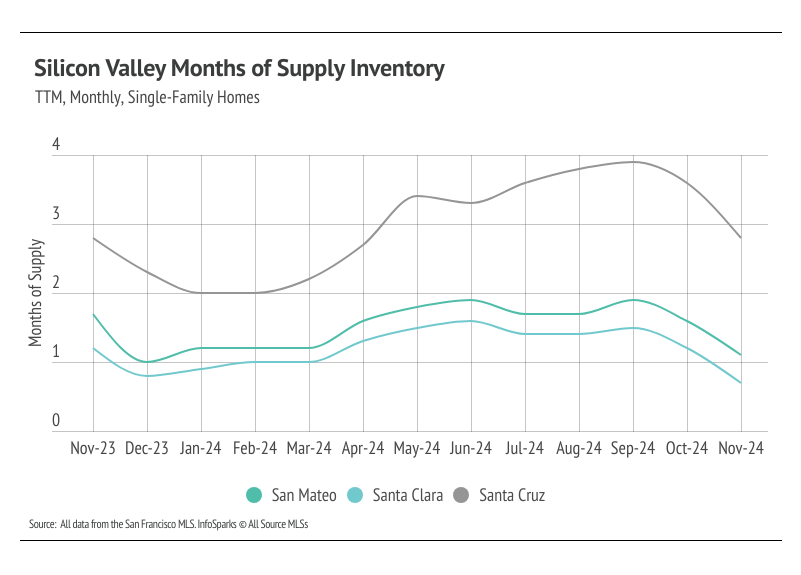

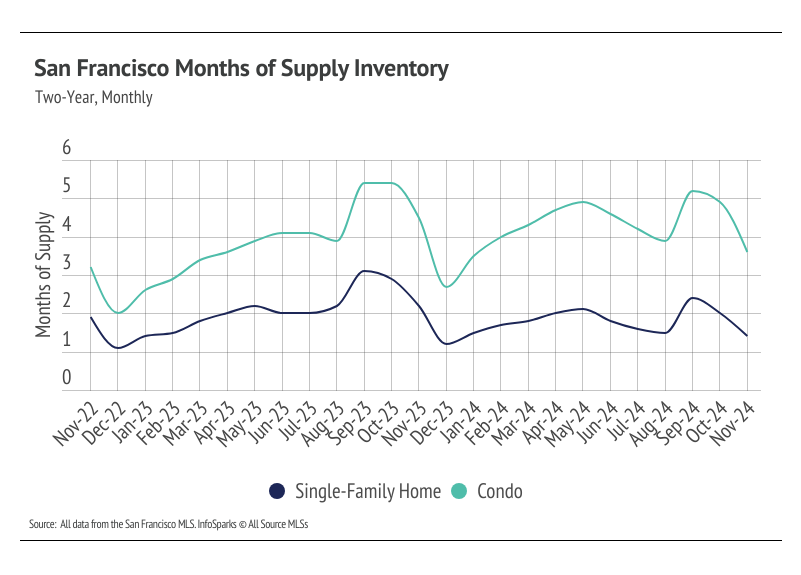

- Months of Supply Inventory declined over the past two months and currently indicates a sellers’ market, with the exception of Napa, which favors buyers.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

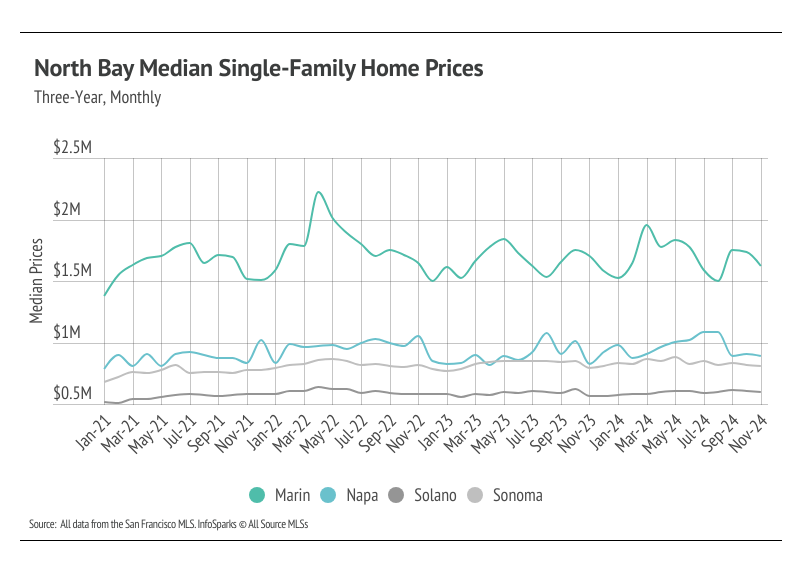

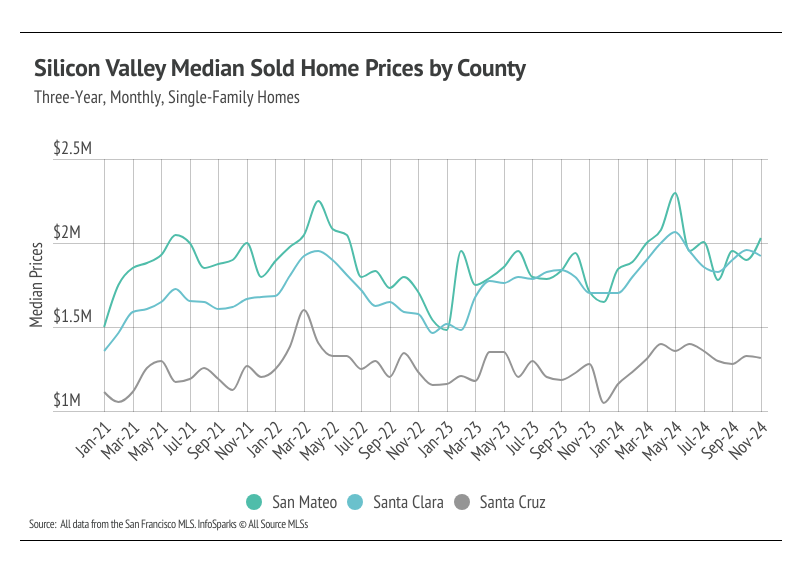

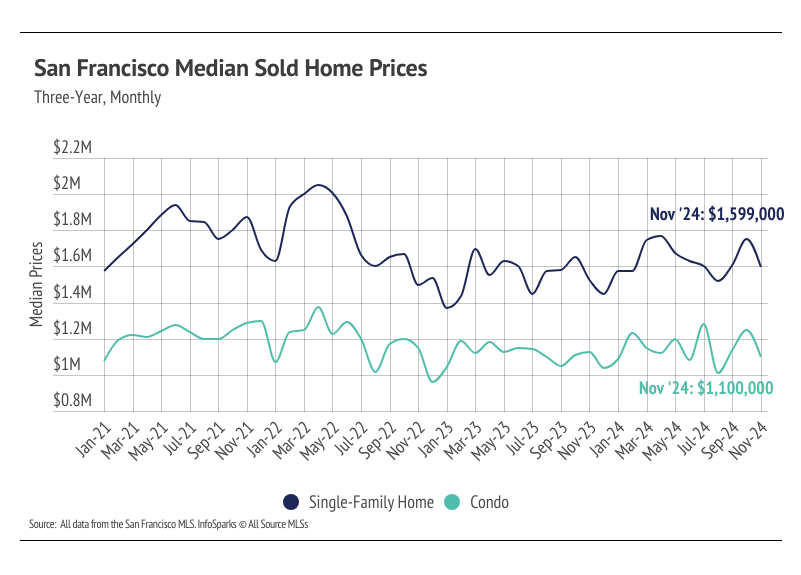

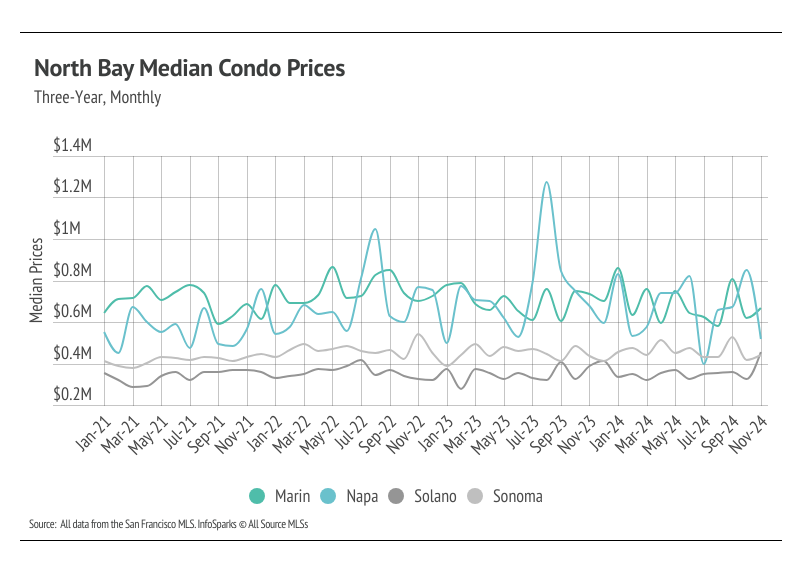

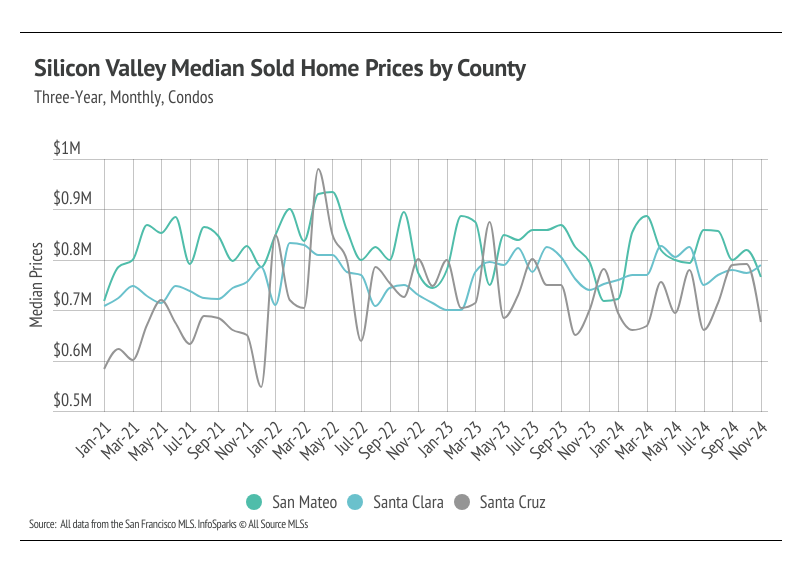

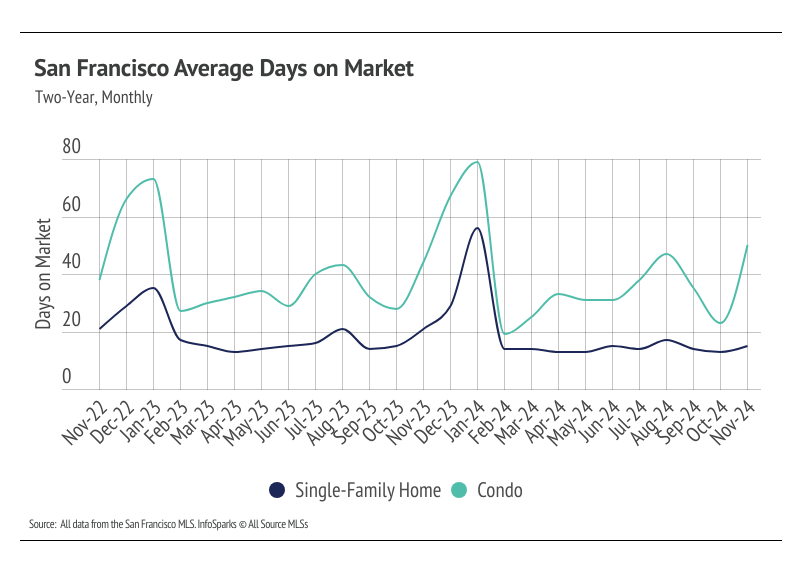

Median prices have risen in 2024 across most of the Bay Area

In the Bay Area, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to January 2023. Low, but growing inventory and high demand have more than offset the downward price pressure from higher mortgage rates. Year to date, in November, the median single-family home and condo prices rose across the Bay Area with the exception of single-family homes in Napa, and condos in Marin and Santa Cruz, which are slightly lower. Year over year, prices increased most significantly for single-family homes in the East Bay, Silicon Valley, and San Francisco. Prices typically peak in the summer months, so we expect some minor price contraction through January 2025.

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates near 6% much more than around 7%. Mortgage rates fell significantly from May through September, but rose significantly in October. Now, rates are far closer to 7% than 6%, so we expect sales to slow further.

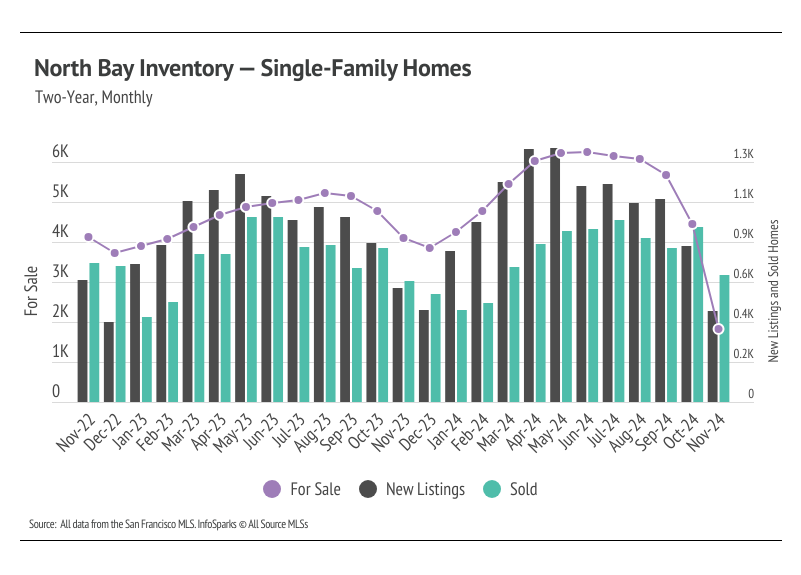

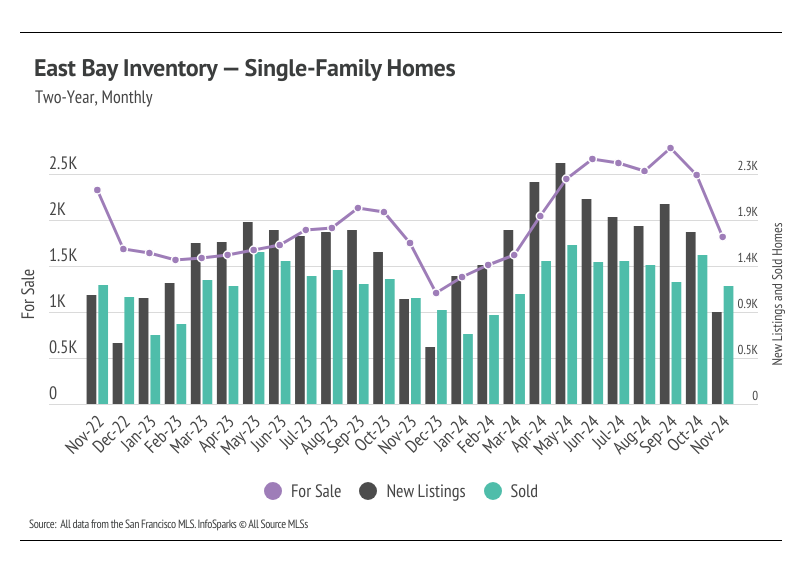

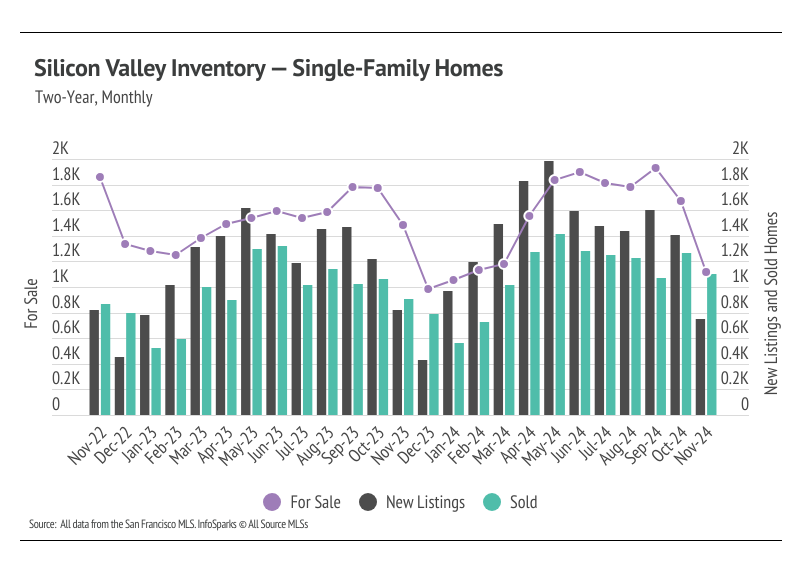

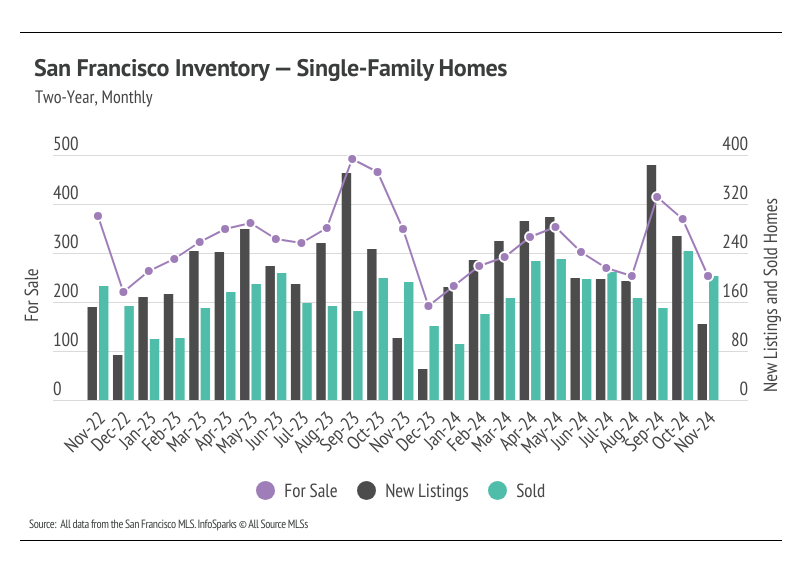

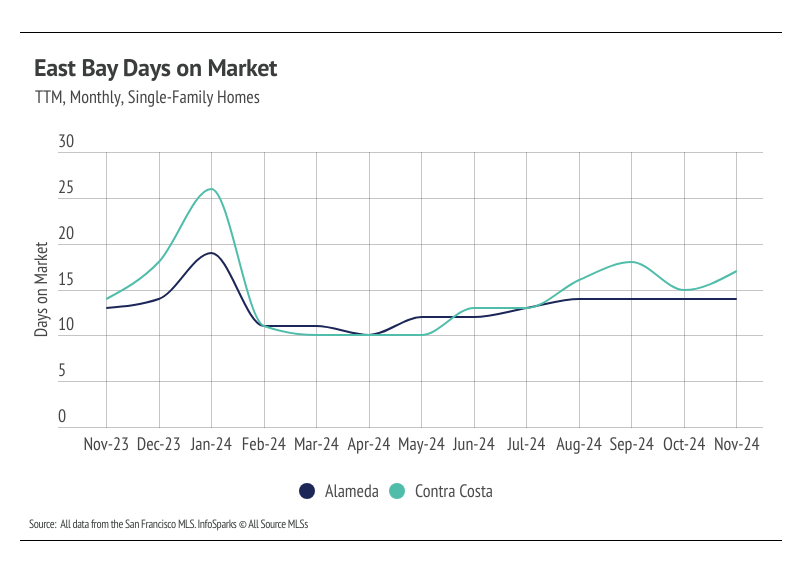

Sales far outpaced new listings in November, causing inventory to drop

In most of the Bay Area, the housing market has looked progressively healthier with each passing month of 2024. We’re far enough into the year to know that inventory levels are about as good as we could’ve hoped in the East Bay and Silicon Valley. That said, inventory across the Bay Area fell significantly in November. In 2023, single-family home inventory followed fairly typical seasonal trends, but at significantly depressed levels. Low inventory and fewer new listings slowed the market considerably last year. Even though sales volume this year was similar to last, far more new listings have come to the market, which has allowed inventory to grow.

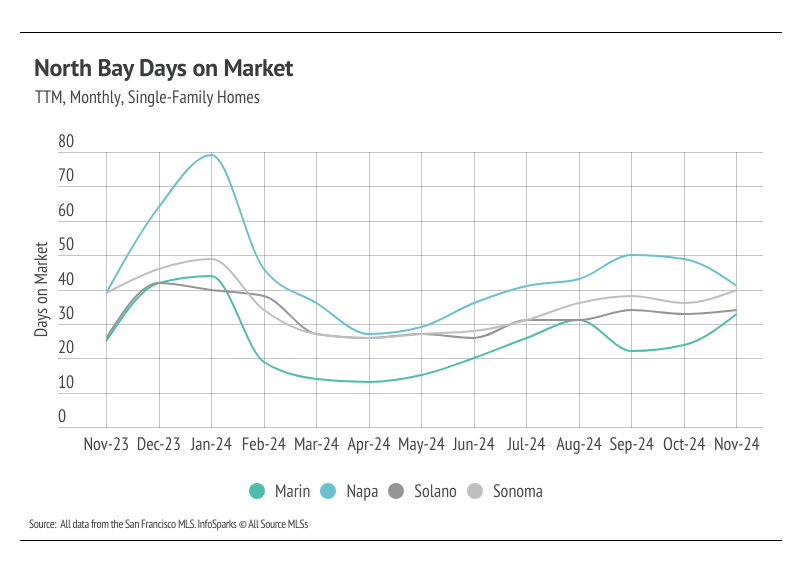

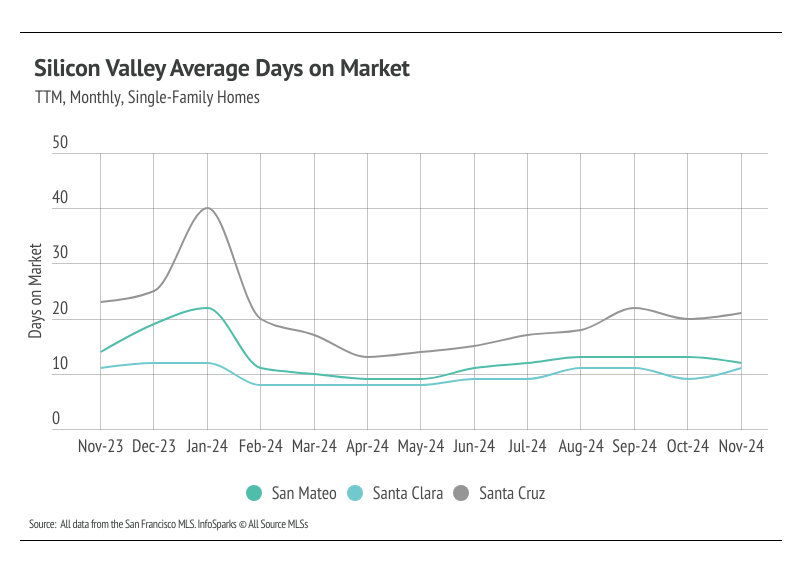

Typically, inventory begins to increase in January or February, peaking in July or August before declining once again from the summer months to the winter. It’s looking like 2024 inventory, sales, and new listings will resemble historically seasonal patterns, and at more normal levels than last year. Notably though, after the inventory declines seen across markets in November, inventory is at an all-time low in the North Bay and near record lows in Silicon Valley and San Francisco.

Months of Supply Inventory indicated a sellers’ market in most of the Bay Area

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Bay Area markets tend to favor sellers, which is reflected in their low MSIs. Currently, MSI is below three months of supply (a sellers’ market) in every Bay Area county, except for single-family homes in Napa, which favor buyers.